Articul8, the enterprise artificial intelligence specialist that emerged from Intel Corporation’s internal incubation efforts in early 2024, has achieved a significant financial milestone, securing over half of a planned $70 million Series B funding round at a robust pre-money valuation of $500 million. This capital infusion underscores the accelerating market appetite for highly specialized, auditable AI solutions, particularly within heavily regulated industries where data integrity and control supersede the convenience of generalized cloud-based models. Articul8 founder and CEO, Arun K. Subramaniyan, confirmed the successful initial close of the two-installment Series B, led by the Spanish venture capital firm Adara Ventures. While specific financial details regarding the initial tranche were not disclosed, the Santa Clara-based company anticipates finalizing the full $70 million round within the current quarter, signaling strong investor confidence in its unique market positioning.

The valuation achieved in this current round represents a staggering fivefold increase from the company’s $100 million post-money valuation just months prior, following its Series A funding in January 2024. This rapid escalation in perceived value is not speculative; it is directly tethered to verifiable commercial success. Articul8 has disclosed that it has already surpassed $90 million in Total Contract Value (TCV)—the cumulative monetary measure of all signed customer agreements—drawn from a roster of 29 established, paying customers. This client list includes major industry players such as Hitachi Energy, financial giant Franklin Templeton, and even its parent company, Intel, alongside strategic partner and sometimes competitor, Amazon Web Services (AWS).

Subramaniyan emphasized the company’s strong financial health, noting that the Series B was pursued not out of necessity, but as a strategic move to accelerate growth. He described Articul8 as revenue-positive following the closure of several significant enterprise contracts, confidently stating, “We are not cash-strapped.” This position of financial stability provides the company with significant leverage, allowing it to dictate terms and focus the capital entirely on strategic scaling and technological advancement, rather than simply extending its operational runway. Looking ahead, the company projects finishing the current fiscal year with an Annual Recurring Revenue (ARR) exceeding $57 million, with approximately half of that figure already realized and recognized on the books. This blend of strong TCV, positive revenue status, and aggressive ARR projections paints the picture of a startup transitioning swiftly into a scale-up with proven product-market fit in a high-demand sector.

The Strategic Pivot: Specialization Over Commoditization

Articul8’s foundational business model is a direct challenge to the prevailing centralized paradigm dominated by hyperscale cloud providers. The company develops highly specialized AI systems designed to operate within the customer’s proprietary IT infrastructure—be it on-premise, in a private cloud environment, or within a specific virtual private cloud (VPC) dedicated entirely to the client. This architectural choice bypasses the inherent risks associated with shared, general-purpose models running on multi-tenant cloud platforms.

The core technology is not marketed as a standalone large language model (LLM) or generative AI foundation model; instead, Articul8 packages its intelligence as bespoke software applications and specialized AI agents. These are meticulously tailored to specific, high-value business functions within industries defined by stringent regulatory oversight, including aerospace, financial services, energy, manufacturing, and the semiconductor supply chain. In these sectors, the non-negotiable requirements are accuracy, stringent auditability, data residency compliance, and absolute control over proprietary data—factors often compromised when using off-the-shelf, general-purpose AI.

CEO Subramaniyan acknowledged the vast competitive landscape, noting that "Our competition is pretty much everybody." However, he sharply differentiated Articul8’s value proposition by targeting the inevitable commoditization of generalized AI services offered by major cloud service providers (CSPs). “Today, the major competitors are the cloud service providers, because they have realized that their model, as the general-purpose [offerings], are all commodities,” he stated.

Expert Analysis: The Shift to Domain-Specific Intelligence

The investment climate surrounding Articul8 validates a crucial trend in the enterprise technology adoption cycle: the maturation of AI from a generalized tool into a domain-specific utility. While foundation models like GPT-4 or Claude excel at broad conversational tasks and content generation, they struggle with the deep, specialized context, zero-tolerance for hallucination, and rigorous traceability demanded by fields like predictive maintenance in nuclear energy or fraud detection in high-frequency trading.

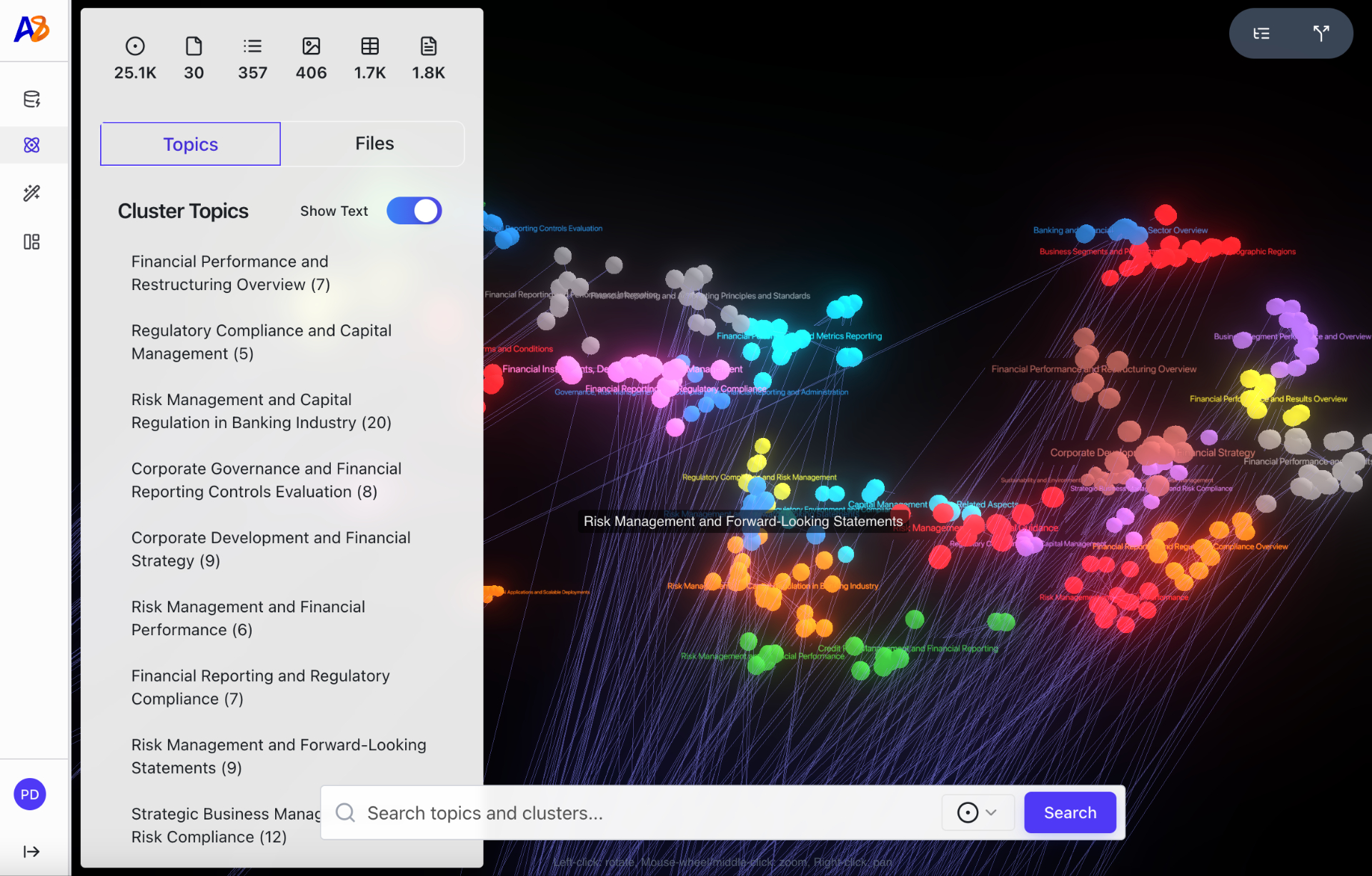

This is where Articul8’s specialized approach—often utilizing techniques like sophisticated Retrieval-Augmented Generation (RAG) coupled with proprietary knowledge graphs—gains critical traction. By running models locally or within isolated customer environments, Articul8 ensures that the AI’s reasoning and outputs are entirely grounded in the customer’s verified, internal data ecosystem. This operational model solves the "black box" problem prevalent in generalized AI, providing clear audit trails and predictable results—a mandate for compliance officers globally.

The architecture inherently mitigates three major enterprise concerns:

- Data Sovereignty: By keeping the processing and proprietary data within the customer’s boundary, geographic data residency requirements (critical in Europe and parts of Asia) are easily met.

- Security and IP Protection: Sensitive intellectual property (IP), manufacturing secrets, or financial data never need to traverse external, multi-tenant cloud infrastructure, drastically reducing the attack surface and risk of accidental data leakage.

- Predictable Performance: Dedicated, fine-tuned models running on optimized infrastructure (often leveraging partnerships with hardware innovators like Nvidia and cloud environments like Google Cloud) deliver consistent, low-latency performance essential for real-time operational decisions.

The willingness of firms like Adara Ventures—which has a dedicated energy focus, often backed by institutions like the European Investment Fund (EIF)—to lead this round signals a major institutional belief in this verticalized strategy. They are investing not just in software, but in a compliance-ready methodology tailored for highly capitalized, regulated infrastructure markets.

Industry Implications: Compliance-First AI and Regulatory Pressure

The momentum behind Articul8 is inextricably linked to the global regulatory environment that is rapidly evolving to govern AI deployment. The European Union’s forthcoming AI Act, coupled with stricter financial regulations (such as those imposed by the SEC in the U.S.) regarding technology risk management, is forcing enterprise adoption to prioritize compliance over feature richness.

In financial services, for instance, models used for lending decisions or algorithmic trading must be explainable (XAI) and auditable to prevent bias and ensure regulatory adherence. A general-purpose LLM, trained on petabytes of unstructured public internet data, often fails this explainability test. Conversely, Articul8’s domain-specific agents, trained primarily on the client’s clean, verified datasets and operating under strict data governance protocols, provide the necessary transparency.

For industrial sectors like aerospace and manufacturing, AI deployment directly impacts physical safety and core operations. The use of AI agents for quality control or robotic process automation requires guarantees of accuracy that generic cloud models cannot offer. The cost of error in these fields is measured in billions of dollars or, worse, human lives. Consequently, the ability to deploy AI that is certified, contained, and controllable is a non-negotiable requirement that hyperscalers are currently struggling to meet with their broad offerings. Articul8’s specialization taps directly into this massive, untapped reservoir of compliance-driven demand.

Furthermore, the structure of modern enterprise IT necessitates hybrid deployment. Large corporations rarely consolidate entirely into one public cloud; they maintain complex legacy systems, proprietary data centers, and multi-cloud strategies. Articul8’s architecture is designed to integrate seamlessly into these complex environments, providing a unified AI layer regardless of the underlying infrastructure stack. This flexibility is highly appealing to CIOs hesitant to undergo a complete and costly migration to a single public cloud vendor.

Scaling Strategy and Global Footprint

The capital injection from the Series B is earmarked primarily for scaling research and product development, along with aggressive international expansion. The company’s current workforce of 75 professionals is heavily skewed toward innovation, with approximately 80% dedicated to R&D, spread across key technology hubs in the U.S., Brazil, and India. This R&D focus ensures that the specialized solutions remain cutting-edge and adaptable to new domain requirements.

Geographically, Articul8 is strategically targeting rapid scaling across Europe and specific Asian markets. The participation of Adara Ventures, with its strong European roots and connection to the EIF, is instrumental in accelerating market entry across the continent, particularly targeting clients in the energy transition and industrial sectors where adherence to the AI Act will soon become paramount.

Concurrently, Articul8 is prioritizing expansion into key Asian technology markets, including Japan and South Korea. These nations host vast manufacturing and semiconductor industries—core target verticals for the company—and have demonstrated high readiness for adopting advanced, localized enterprise AI solutions. The CEO noted that large enterprise customer relationships are already being established in these regions. The presence of India’s Aditya Birla Ventures in the funding round further solidifies Articul8’s commitment to building a robust presence across the APAC region.

The company’s operational strategy involves a dual approach of partnership and competition. While Articul8 directly competes with the commoditized offerings of CSPs, it simultaneously partners with major technology groups. Collaborations with hardware titans like Nvidia are essential for optimizing the performance of its specialized models on cutting-edge accelerators. Similarly, despite viewing CSPs as competition in the generalized AI space, Articul8 utilizes platforms like Google Cloud and maintains a dynamic customer-partner relationship with Amazon Web Services (AWS) for specific, secure enterprise deployments. This co-opetition model reflects the complex reality of the modern cloud ecosystem, where specialization thrives by leveraging the foundational infrastructure provided by the hyperscalers while offering differentiated, high-compliance applications.

Future Trajectories and Market Impact

Articul8’s current trajectory signals a broader future trend: the fragmentation of the generative AI market into specialized, high-margin segments. As general LLMs become interchangeable utility services, the real value creation shifts to the platforms that can deploy and manage tailored, reliable, and compliant AI agents directly within the enterprise’s operational flow.

The company is positioning itself not merely as an AI vendor, but as an enabler of digital transformation in highly sensitive environments. The ability to guarantee auditability and data control transforms AI from an experimental technology into a core, mission-critical operational component. This reliability will be the key differentiator in securing multi-year contracts with large, blue-chip clients in sectors that prioritize resilience and risk mitigation above all else.

The success of this Series B, achieved while demonstrating revenue positivity and a fivefold valuation jump in under a year since spinning out of Intel, serves as a powerful market barometer. It suggests that the enterprise AI market is now moving past the initial hype surrounding large, generalized models and is ready to commit serious capital to practical, isolated, and compliant solutions. Articul8’s focus on the deep needs of regulated industries—where the barriers to entry are high and the demand for trust is absolute—positions it as a potentially defining force in the next wave of enterprise AI adoption, fundamentally altering the competitive dynamics currently dominated by cloud infrastructure giants.