The curtain closed on one of the autonomous vehicle sector’s most prominent, albeit financially troubled, suppliers this week, as a bankruptcy judge granted final approval for the sale of Luminar’s core business segments. The culmination of the Chapter 11 proceedings, however, was marked by extraordinary boardroom drama, as an unsolicited, substantially higher offer materialized mere moments before the scheduled judicial rubber stamp, threatening to derail the carefully negotiated transfer of assets to MicroVision.

This eleventh-hour maneuver, occurring just ahead of the Tuesday hearing, triggered immediate and intense internal consultation. Luminar’s remaining executive leadership, their legal counsel, and the "special transaction committee" established to oversee the arduous bankruptcy process were thrust into a series of rapid-fire emergency sessions, ultimately requiring the full corporate board’s involvement.

The surprise bid, which significantly surpassed the existing $33 million offer MicroVision had secured during the prior day’s auction, was ultimately rejected. Luminar’s legal representatives cited crucial "infirmities" within the proposal, suggesting that while the financial value was compelling, the lack of certainty, structure, or immediate liquidity rendered the offer non-viable under the stringent requirements of a bankruptcy sale. The company determined that maintaining stability and ensuring a swift, clean close was paramount, electing to proceed with the $33 million Asset Purchase Agreement (APA) with MicroVision.

The identity of the party attempting this last-ditch intervention was not formally disclosed in court, yet Luminar’s counsel indicated the bid originated from an "insider purchaser." This description strongly points to Austin Russell, the charismatic founder who led Luminar through its initial hyper-growth phase and subsequent public offering. Russell had previously made attempts to acquire the company late last year, following his abrupt resignation as CEO, and representatives from his new venture, Russell AI Labs, had confirmed ongoing interest in submitting a bid for the key lidar technologies during the bankruptcy proceedings. This final, failed attempt represents the definitive end of Russell’s corporate relationship with the company he founded and brought to prominence.

With the late drama resolved, the court moved forward, formally approving the sale of the long-range lidar business and associated intellectual property to MicroVision. Simultaneously, the company’s semiconductor division, a critical component of its vertically integrated hardware approach, was approved for sale to Quantum Computing Inc. These transactions are anticipated to close in the near future, marking the official cessation of Luminar as an operating entity and drawing a definitive conclusion to one of the most high-profile sagas in the burgeoning autonomous supply chain.

The Context of Collapse: High Hopes and Harsh Reality

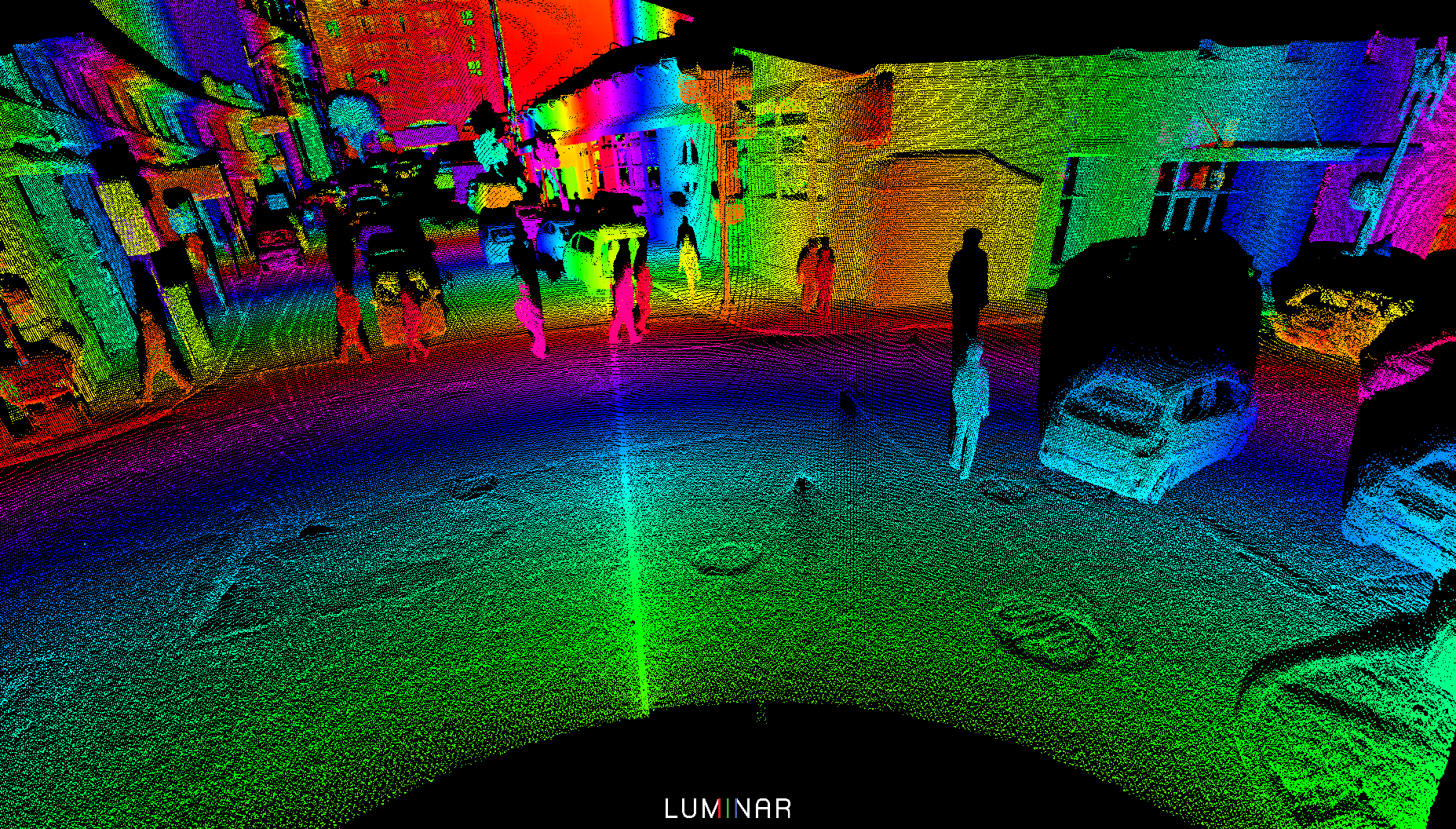

To understand the stakes of this asset transfer, one must recall Luminar’s meteoric rise. Founded on the promise of developing superior, long-range 1550-nanometer lidar—a technology crucial for Level 3 and Level 4 autonomy on highways—Luminar became a darling of the SPAC boom era. Its public debut resulted in a valuation exceeding that of several established automotive suppliers, driven by a compelling narrative and strong commercial engagements, most notably with Volvo.

The underlying challenge faced by Luminar, and indeed many pure-play lidar startups, was the brutal reality of the automotive qualification cycle. OEMs demand years of rigorous testing, massive scalability, and, critically, steep price compression. While Luminar’s technology was technically robust, its cost structure remained high, and the anticipated mass adoption of autonomous driving systems lagged market expectations. This misalignment between high R&D spending, lengthy qualification periods, and the immediate need for revenue ultimately eroded investor confidence and led to its insolvency.

The Chapter 11 filing allowed for the orderly liquidation of assets, maximizing returns for creditors. In this context, the auction process is designed not only to achieve the highest monetary value but also to ensure the buyer possesses the financial stability and regulatory clearance to complete the transaction quickly—a factor that proved critical in rejecting the founder’s last-minute, albeit higher, offer.

MicroVision’s Strategic Calculus: Filling the Portfolio Gap

For Redmond, Washington-based MicroVision, the acquisition of Luminar’s lidar technology is a transformative strategic maneuver, offering a vital component missing from its existing product stack. MicroVision, while possessing a strong background in short-range sensing, industrial applications, and defense contracts, lacked the sophisticated, long-range capabilities necessary to compete effectively for major automotive OEM programs.

Glen DeVos, MicroVision’s CEO, articulated the rationale for the acquisition. With a distinguished career spanning decades at Tier 1 automotive suppliers like Delphi and Aptiv, DeVos brings an operational maturity that contrasts sharply with the startup culture that characterized Luminar. He recognized that while MicroVision boasted a formidable software team and competent short-range lidar hardware, the Luminar acquisition provides the specialized engineering prowess and the 1550nm architecture essential for high-speed highway autonomy.

"When we look at the Luminar engineering team and what they’ve achieved, we see an outstanding complement to our existing capabilities," DeVos explained. "This long-range sensing capability is absolutely critical for winning significant automotive business moving forward."

The acquisition includes not only the intellectual property and hardware designs but also the retention of key Luminar personnel. DeVos expressed optimism about bringing back some of the talented engineers and specialists laid off during Luminar’s pre-bankruptcy restructuring, viewing the integration of this talent pool as equally valuable as the technology itself. The goal is to rapidly merge the two companies’ strengths: MicroVision’s robust industrial presence and software infrastructure, combined with Luminar’s advanced long-range hardware.

The Challenge of Salvaging Commercial Engagements

Beyond technology and talent, MicroVision inherits Luminar’s existing commercial engagements with major automakers. These relationships, however, are often described as being "in tatters" due to the seller’s financial collapse, particularly the high-profile contract with Volvo, which had previously soured and contributed significantly to Luminar’s financial woes.

DeVos, drawing on his extensive experience in the complex world of automotive supply chains, is determined to attempt resuscitation. He acknowledged that contractual relationships frequently encounter severe challenges, but stressed that they are not necessarily beyond saving. "I have significant experience where these relationships have gone off the rails, and I’ve worked very hard to piece them back together," DeVos stated. "We will meticulously examine every single engagement. We cannot assume any of them are irrecoverable."

The difficulty in this endeavor cannot be overstated. Automotive OEMs prioritize supply chain stability above almost all else. A supplier undergoing bankruptcy, regardless of the quality of its technology, raises immediate red flags concerning future reliability, warranty coverage, and long-term support. MicroVision’s primary task now is to leverage its own financial stability and DeVos’s reputation within the industry to rebuild trust and convince former Luminar partners that the technology—now backed by a solvent, focused entity—remains the viable path forward for their autonomous platforms.

The Shadowy World of Competing Bids and Due Diligence

The eleventh-hour insider bid was not the only instance of intrigue surrounding the Luminar sale process. Earlier in the proceedings, MicroVision and the Luminar advisory team, led by investment bankers such as Rich Morgner, a managing director at Jeffries, had to contend with an entirely separate, highly complex, and ultimately unsuccessful attempt by another unidentified party to structure a bid.

Morgner revealed details during the hearing regarding a bidder that first emerged in January, whose financing structure presented immediate and serious due diligence concerns. Initially, the funding for this bid was slated to come from a "Chinese national company." Given the sensitive nature of lidar technology—which has significant dual-use (commercial and military) potential and often falls under the scrutiny of the Committee on Foreign Investment in the United States (CFIUS)—Luminar’s advisors immediately raised regulatory approval concerns.

In response, the bidder attempted to restructure its funding using three non-Chinese sources. Morgner detailed the dubious nature of this revised syndicate:

- Verified Family Money: A portion of the funding was sourced from verifiable private family assets.

- Cayman Islands SPV: A significant sum was channeled through a Special Purpose Vehicle (SPV) registered in the Cayman Islands, backed by a brokerage statement showing a large, suspiciously "round number" of funds.

- European Family Office: A third component was claimed to originate from a European family office, though proof of funds was never definitively provided.

The bankers expressed deep suspicion regarding the Cayman SPV. Morgner explained that seeing a large, round figure suddenly appear in a brokerage statement, rather than observing the natural "ebbs and flows" typical of long-dated investment accounts, suggested the money might have been temporarily "parked" to create the illusion of liquidity. The concern was that these funds could be withdrawn as quickly as they appeared, rendering the bid financially unstable and placing the company at undue risk in the event of default.

This detailed account underscores the high-stakes, multi-layered complexity of bankruptcy auctions, where the validity and dependability of financing often outweigh the absolute dollar amount of a bid, especially when national security and regulatory compliance are factors. The fact that the ultimate approved bid was clean, immediate, and fully verifiable was a decisive factor in the court’s decision, reinforcing the notion that in bankruptcy, certainty trumps speculation.

Industry Consolidation and Future Trends

The final sale of Luminar is symptomatic of a larger trend of consolidation sweeping through the lidar industry. The market, once populated by dozens of heavily venture-backed startups—many of which pursued SPAC listings during the pandemic era—is now maturing rapidly. Companies like Aeva, Innoviz, Hesai, and Ouster are competing fiercely for limited OEM design wins, leading to relentless pressure on pricing and the necessity of achieving scale.

Luminar’s technology lives on through MicroVision, but its failure serves as a cautionary tale. It highlights the immense capital required and the protracted timeline needed to succeed in the automotive sensor space. For MicroVision, successfully integrating Luminar’s assets and reviving the commercial pipeline will determine whether this acquisition provides the necessary springboard into the automotive mainstream or merely adds another layer of complexity to its operations.

The industry consensus suggests that future success in lidar will depend on offering a complete, integrated sensing suite—combining long-range, short-range, and robust perception software—at a price point amenable to mass production vehicles. By acquiring Luminar’s long-range expertise, MicroVision has positioned itself to offer such a comprehensive solution. The coming months will be critical, testing DeVos’s ability to transition the promising, yet bankrupt, intellectual property into a commercially reliable and scalable product fit for the global automotive market. The legacy of Luminar, therefore, will not be its spectacular failure, but the foundational technology it contributed to the next generation of autonomous mobility, now under new stewardship.