The annual meeting of the World Economic Forum (WEF) in Davos, Switzerland, traditionally serves as a crucible for global leaders—politicians, economists, and royalty—to address macro-level challenges such as climate change, poverty, and international trade disputes. This year, however, the venerable event experienced a profound thematic and physical transformation, effectively morphing into a high-powered, exclusive conference dedicated almost entirely to the commercial and geopolitical implications of Artificial Intelligence. The shift was undeniable: the quiet, globalist introspection that once characterized the Alpine gathering was replaced by the aggressive, competitive rhetoric of Silicon Valley’s elite, foregrounding AI as the singular force driving global capital allocation and strategic policy.

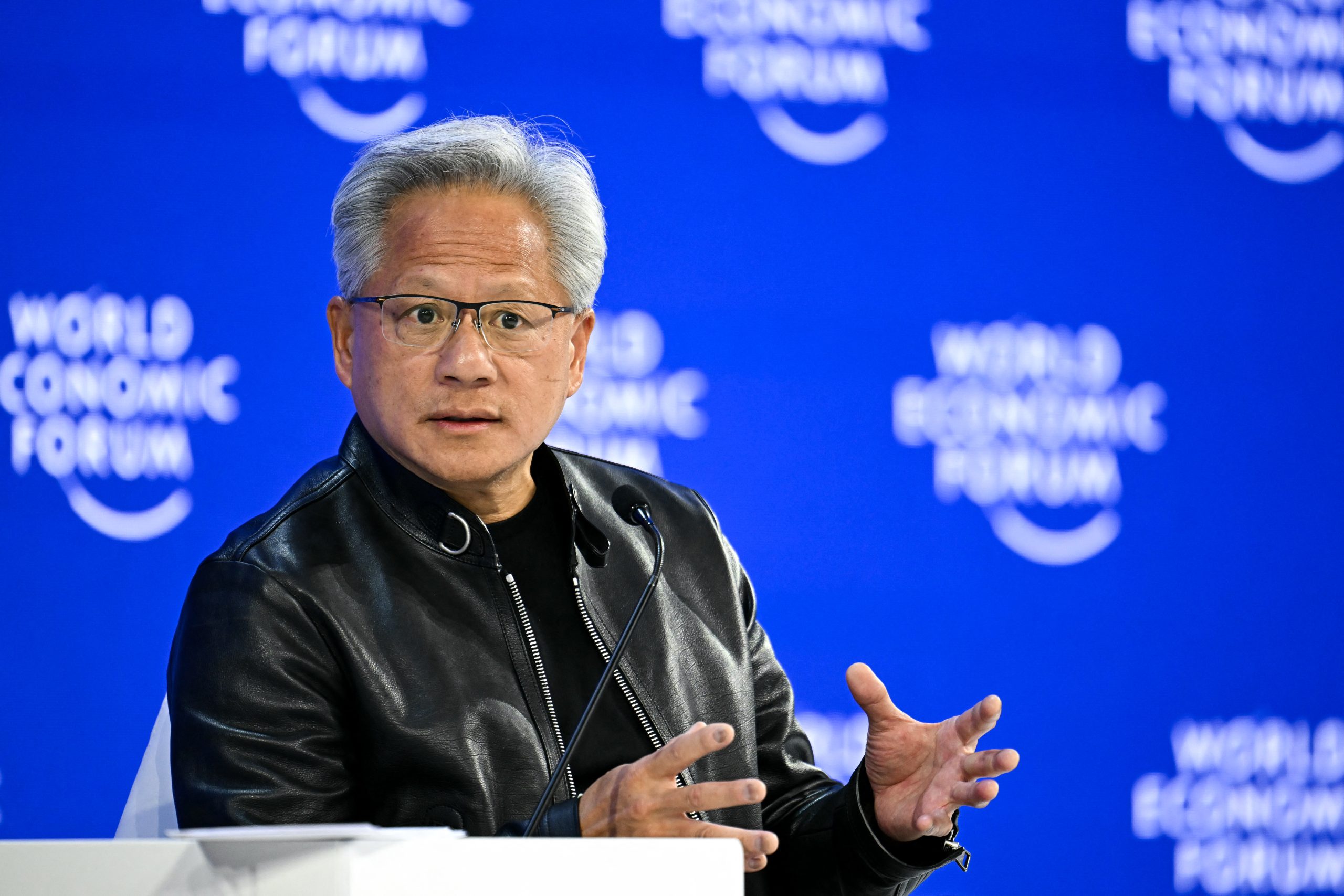

The concentration of tech star power was unprecedented. Prominent figures including Microsoft CEO Satya Nadella, Nvidia CEO Jensen Huang, Tesla and X chief Elon Musk, and Anthropic CEO Dario Amodei commanded the main stages, often overshadowing panels dedicated to traditional WEF priorities. Visually, the change was striking. Where non-governmental organizations and diplomatic entities once occupied prime real estate along the Davos Promenade, storefronts were conspicuously leased and converted into corporate hubs for technology giants like Meta, Salesforce, and Microsoft. This physical colonization symbolized the financial and narrative dominance exerted by the tech industry, signaling a decisive pivot away from humanitarian crisis management toward technological industrial policy.

The central thesis presented by the attending CEOs revolved around the transformative, paradigm-shifting potential of generative AI. Yet, beneath the veneer of utopian technological forecasting, a palpable tension existed—the persistent fear that the massive capital expenditures (CapEx) currently driving the sector are inflating an unsustainable economic bubble. This duality—boasting world-changing capabilities while simultaneously battling market skepticism—resulted in an atmosphere of intense competition, with executives frequently engaging in strategic critiques, often aimed not just at direct competitors but at vital supply chain partners.

The Geopolitics of Computation and the China Chokepoint

A prime example of this complex internal rivalry emerged during the commentary surrounding global trade and hardware scarcity. Dario Amodei, the chief executive of AI safety-focused Anthropic, used the Davos platform to launch a sharp, albeit strategically delicate, critique of US semiconductor export policy. Amodei specifically questioned the rationale behind regulatory decisions that permit chip powerhouse Nvidia, a crucial supplier to Anthropic, to continue selling advanced components to China, albeit with certain restrictions.

Amodei’s argument synthesized geopolitical concern with commercial self-interest, positing that the construction of large-scale AI data centers equipped with cutting-edge accelerators effectively transfers substantial intellectual and computational power. He used striking, hyperbolic language to emphasize the strategic value of this infrastructure, describing an AI data center as "a country full of geniuses." The implication was clear: if the US and its allies genuinely view China as a strategic competitor in the race for technological supremacy, allowing the transfer of the foundational hardware necessary to build powerful large language models (LLMs) represents a critical strategic vulnerability.

This dynamic is particularly complex because Anthropic is a major consumer of Nvidia’s Graphics Processing Units (GPUs). Amodei’s public criticism highlights the deep, often contradictory, dependencies within the AI ecosystem. AI developers rely entirely on Nvidia’s hardware dominance, yet they simultaneously fret over the geopolitical consequences of that hardware’s distribution and the ensuing market power concentrated in a single supplier. This public "sniping," occurring on a stage traditionally reserved for diplomatic consensus, underscored the high stakes of the AI race, where national security interests, corporate profit motives, and supply chain bottlenecks intersect.

The Rhetoric of the Bubble: Token Factories and Investment Mandates

The executives’ public discourse was characterized not just by strategic rivalry but also by a distinct lexicon designed to manage expectations, drive investment, and justify astronomical valuations. Microsoft’s Satya Nadella, a key architect of the current AI boom through the company’s extensive partnership with OpenAI, introduced the concept of data centers as "token factories." This abstraction reduces the immense physical infrastructure and computational complexity into a simple, scalable unit of output (tokens), effectively framing the massive CapEx investment as an industrial input necessary for scalable product generation.

Nadella’s rhetoric carried a subtle but urgent appeal for broader adoption. His message was interpreted by many analysts as a direct plea for increased usage across diverse industries and communities. The underlying tension he addressed was the fear of a CapEx crisis: billions are being poured into constructing these "token factories," but if the utilization rates (usage) do not follow suit rapidly, the returns on investment will collapse, leading to a swift and painful correction. Nadella’s focus on equitable global adoption—ensuring AI benefits extend beyond only the wealthiest entities—serves not only a moral purpose but also a crucial business imperative: maximizing the addressable market to prevent the AI bubble from bursting.

Contrastingly, Jensen Huang, whose company Nvidia currently occupies the most economically strategic position in the AI stack, focused his message on the necessity of accelerating infrastructure investment. While Nadella argued for greater usage to justify existing investment, Huang argued that the current investment levels remain insufficient to unlock AI’s full potential. He framed the build-out as a massive engine for job creation and economic revitalization. This perspective, however, neatly sidesteps the eventual deceleration of infrastructure deployment. The current pace of data center construction and GPU procurement cannot be sustained indefinitely, raising questions about what happens when the initial build-out phase transitions to a slower, maintenance-focused phase.

The real-time public friction between these industry leaders—rarely witnessed simultaneously on a single global stage like Davos—revealed the intense, behind-the-scenes jockeying for market leadership and talent acquisition. The traditional competitive landscape between software providers (Microsoft, Anthropic, Google) is now intrinsically linked to and constrained by the hardware supply chain (Nvidia). The palpable tension in the room reflected the desperate effort to attract and retain the highly specialized talent required to manage these complex systems without financially crippling their organizations through an excessive compensation arms race.

Industry Implications: The Consolidation of Power

The AI-centric Davos meeting solidified several critical industry implications for the coming decade.

First, it underscored the unprecedented concentration of power at the foundational layers of the AI stack. Nvidia’s market capitalization and strategic importance have soared precisely because they control the chokepoint—the supply of high-performance accelerators indispensable for training and deploying large models. This control grants them leverage far exceeding typical vendor-client relationships, allowing them to dictate pricing and allocation to hyperscalers and developers alike, a dynamic clearly motivating Amodei’s public comments.

Second, the discourse highlighted the massive barriers to entry now defining the AI industry. The cost of building a state-of-the-art LLM platform—the "token factory"—is so prohibitive that only governments or the largest technology conglomerates can realistically compete. This trend is leading toward an oligopoly structure, where innovation, while potentially widespread, remains dependent on access to the computational resources controlled by a few dominant players. This realization pushes the debate over AI regulation beyond safety concerns and into the realm of economic antitrust and market concentration.

Third, the focus on AI effectively relegated other pressing global issues, such as climate financing and poverty reduction, to secondary status. While climate change demands equally massive global coordination and investment, the immediate, explosive commercial returns offered by AI have monopolized the attention of global capital and political leadership. This "AI tunnel vision" risks diverting crucial resources and intellectual bandwidth away from existential challenges that lack the immediate, high-growth revenue potential of generative technology.

Future Trajectories: Sovereign AI and Global Stratification

Looking ahead, the conversations initiated at Davos suggest several inevitable future trends, primarily centered on geopolitical stratification and the emergence of "Sovereign AI."

The friction over chip exports foreshadows a rapid decoupling in technological standards and infrastructure between the US-led sphere and China. Countries are increasingly recognizing that computational power is the new geopolitical currency. This realization will spur nations, particularly those with significant economic power (like Middle Eastern sovereign wealth funds, as noted by their increased presence at Davos), to invest aggressively in building their own domestic AI infrastructure—their own "token factories"—to ensure they are not reliant on the volatile global supply chain or the political whims of foreign powers. This pursuit of "Sovereign AI" ensures technological autonomy but simultaneously fragments the global AI landscape, potentially leading to diverging standards, ethics, and capabilities.

Furthermore, the need for increased usage, as articulated by Nadella, signals a forthcoming aggressive phase of commercialization. The immense CapEx currently being deployed mandates rapid monetization. This means the next few years will see AI pushed into nearly every sector—from personalized medicine and logistics to education and government services—far beyond its current deployment primarily in coding assistance and customer service. This push will test the limits of public trust, regulatory frameworks, and enterprise readiness.

The long-term impact on the labor market remains a critical, unresolved point, despite Jensen Huang’s positive spin on job creation. While the initial phase of AI deployment requires highly skilled engineers and construction workers for infrastructure build-out, the efficiency gains promised by LLMs imply significant productivity increases that may displace knowledge workers. The Davos discussions touched upon this tension without offering concrete solutions, highlighting the risk that the immense wealth generated by AI will be highly concentrated, exacerbating global inequality—a stark irony given the WEF’s stated mission of improving the state of the world.

In conclusion, the transformation of the World Economic Forum into an AI summit signifies that technological supremacy has become the dominant metric of geopolitical and economic power. The candid, competitive exchanges between leaders like Nadella, Huang, and Amodei offered a rare, unvarnished look at the intense commercial pressures, strategic dependencies, and geopolitical risks inherent in the AI race. Davos is no longer merely a venue for discussing global problems; it has become the principal stage where the masters of technology publicly negotiate the terms of the next industrial revolution, revealing that in the modern era, the lines between market rivalry, national strategy, and existential technological growth are now completely blurred.