The dawn of 2026, barely a week old, casts a long shadow over consumer electronics budgets globally. The burgeoning worldwide shortage of Random Access Memory (RAM), driven by soaring demand from the nascent but ravenous Artificial Intelligence (AI) computing sector, is now translating directly into elevated manufacturing costs across the entire gadget ecosystem. In this challenging fiscal landscape, the upcoming launch of the Samsung Galaxy S26 series is slated to arrive with a significant price escalation, according to the latest intelligence filtering through the supply chain. This development is further complicated by the revelation that Samsung Electronics failed to secure a crucial, long-term supply agreement with its internal powerhouse, Samsung Semiconductor, for critical memory modules. Consequently, the consumer electronics giant must now vie for quarterly memory allocations on the open market, competing on equal footing with rivals for finite resources.

This confluence of external pressures and internal supply chain dynamics has created a precarious situation for the S26 lineup, one compounded by significant regional pricing disparities. Initial projections suggest that consumers in South Korea will bear the brunt of the increases, facing hikes approaching 88,000 Korean Won (approximately $60 USD) for the base 256GB configuration. Conversely, industry expectations point toward Samsung maintaining the existing sticker prices in the crucial United States market: $799 for the standard S26, $999 for the Plus variant, and $1,299 for the flagship Ultra model. This strategic decision in the US—a market heavily influenced by Apple’s consistent pricing strategies and substantial market penetration—strongly suggests that Samsung is absorbing considerable cost increases domestically to avoid ceding competitive ground to the iPhone juggernaut.

For consumers outside the US, the implications are stark. The necessity of absorbing escalating component costs directly translates to a higher MSRP, making the S26 series a significantly less attractive proposition internationally. This is exacerbated by the perception that the hardware refinements accompanying the S26 generation are largely iterative rather than revolutionary. This pricing structure threatens to render the Galaxy S26 series potentially one of the most divisive flagship releases in Samsung’s recent history, forcing a tough calculation on consumers regarding perceived value versus outlay.

The Incremental Upgrade Paradox Under Increased Cost Pressure

The core of the value crisis stems from the perceived lack of substantive generational leaps in key hardware areas. For many prospective buyers, the camera specifications appear largely unchanged from previous iterations, and the display technology, while excellent, offers negligible visual differentiation from its predecessor. In essence, customers are being asked to pay a premium—the so-called "RAM tax"—for what feels less like a forward-looking upgrade and more like a necessary compromise to keep pace with rising component costs. This dynamic erodes the consumer incentive to upgrade, particularly for users holding onto recent S-series devices.

To offer some counterpoint, the leaked specifications do point toward several meaningful, albeit modest, internal enhancements. The standard Galaxy S26 is rumored to benefit from an increased base storage capacity and a slightly larger battery cell, though it remains far from the high-capacity offerings seen in some competitor devices. The Galaxy S26 Ultra is anticipated to receive a boost to 65W fast charging capabilities and the adoption of a new M14 display panel, even if the underlying display panel specifications remain broadly similar to the prior generation. Furthermore, all three models will integrate the next-generation processors and incorporate a subtly refined industrial design. The question that remains is whether these incremental advancements—a faster chip, slightly better charging, and minor chassis tweaks—justify a $60 or greater increase in the initial purchase price for international consumers. For many, the calculation might swing toward purchasing the highly capable Galaxy S25 now at a discounted rate, rather than paying a premium for marginal S26 improvements.

The Resurfacing Chip Divide: Exynos vs. Snapdragon

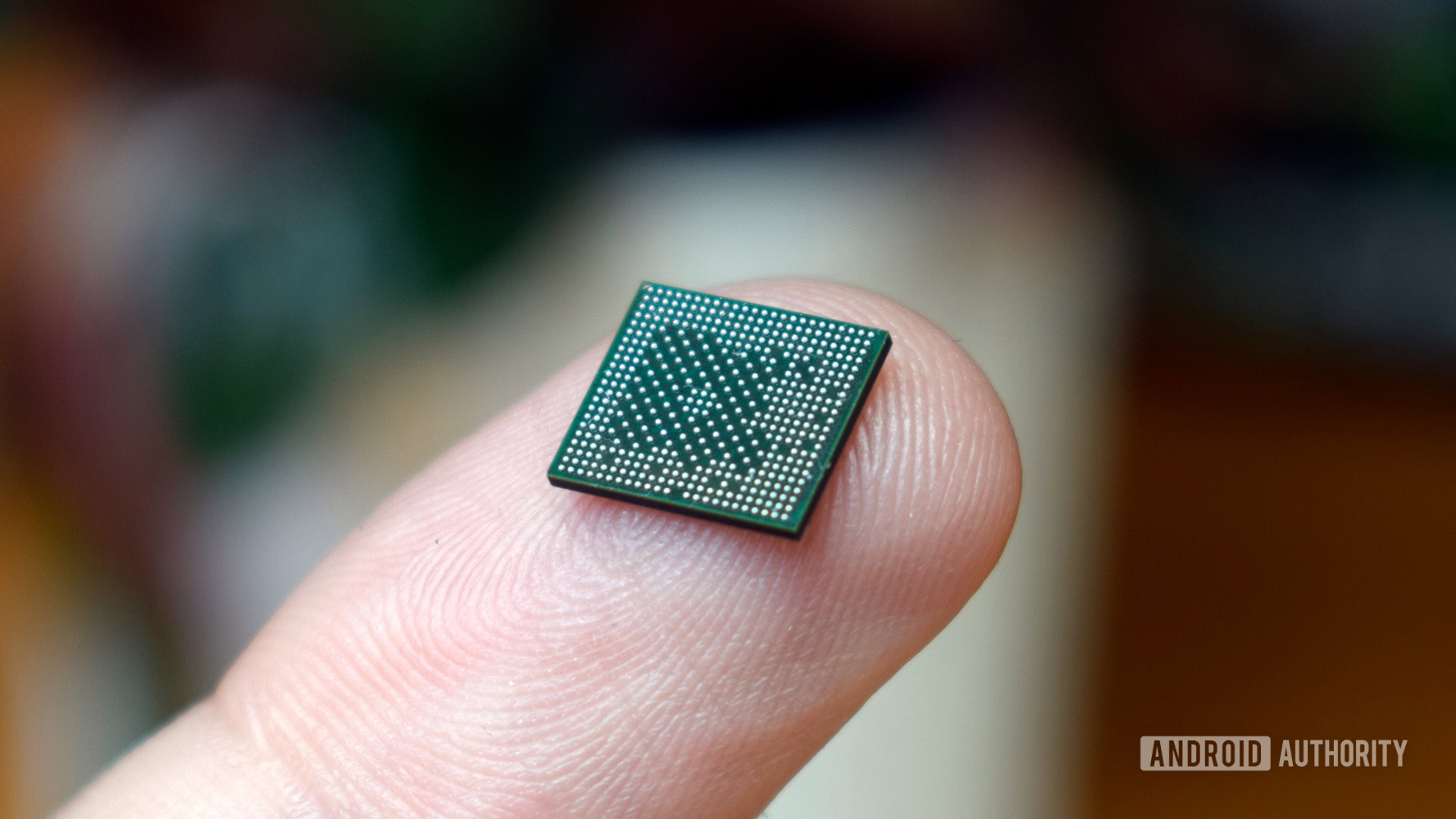

Adding further complexity to the S26 narrative is the return of the long-standing architectural schism: the deployment of both Qualcomm’s Snapdragon and Samsung’s proprietary Exynos chipsets across the lineup. While reliable sources indicate that the premium Galaxy S26 Ultra will universally feature the latest Snapdragon silicon in all global markets—a strategy likely driven by performance parity demands—the standard S26 and S26 Plus are expected to utilize Samsung’s newly minted Exynos 2600 in select regions.

Samsung has historically employed this dual-sourcing strategy, often resulting in passionate backlash from a dedicated segment of its global user base, who frequently cite performance disparities, particularly in sustained gaming or thermal management, between the two variants. While Samsung attempted to standardize on the Snapdragon 8 Elite for the entirety of the S25 series, reportedly due to performance gaps and manufacturing hurdles with the prior Exynos iteration, the return to the dual-chip strategy this year signals a renewed effort to leverage internal silicon capabilities where possible.

The specifications touted for the Exynos 2600 paint a picture of a formidable high-end processor. It reportedly integrates a powerful core configuration featuring an Arm C1-Ultra core clocked at 3.8GHz, complemented by three C1-Pro cores running at 3.25GHz, and six additional C1-Pro cores at 2.75GHz. This is paired with the cutting-edge Xclipse 960 GPU. Furthermore, the entire chip is fabricated using Samsung’s advanced 2nm Gate-All-Around (GAA) process technology, incorporating new dedicated Neural Processing Unit (NPU) engines and enhanced image signal processing units. On paper, the Exynos 2600 represents peak silicon capability for Samsung. However, the critical unknown remains its real-world performance against Qualcomm’s Snapdragon 8 Elite Gen 5, especially concerning efficiency and the crucial benchmark perception battle.

A significant point of contention is the expected cost-saving associated with utilizing the Exynos 2600. Industry analysts had anticipated that deploying their in-house solution, manufactured on their own leading-edge nodes, would yield a production cost reduction of between $20 and $30 per unit compared to sourcing the Snapdragon equivalent. Traditionally, while consumers rarely saw this saving reflected directly, it often served to buffer the overall price increases for the subsequent generation. In the current economic climate, however, it appears that the escalating cost of RAM has entirely consumed this projected margin, and potentially exceeded it. This leaves international consumers in a difficult position: paying more for a device that might feature a less desirable processor, even if the internal cost differential is marginal.

Industry Context and Macroeconomic Headwinds

It is crucial to contextualize Samsung’s predicament within the broader semiconductor market. The company is not operating in isolation; it is grappling with the same universal macroeconomic forces impacting every electronics manufacturer. The current pivot toward AI infrastructure—demanding vast quantities of high-bandwidth memory (HBM) and specialized accelerators—has caused a severe reallocation of manufacturing capacity among memory producers. Lower-margin, high-volume components like the LPDDR memory required for smartphones are experiencing supply constriction and sharp price inflation. Samsung’s inability to secure favorable long-term internal supply contracts with its own memory division highlights the intense competition for available capacity across the entire industry.

This pressure is not unique to Samsung’s flagship line. Evidence of broader inflationary trends is already apparent, with Samsung having quietly implemented price increases for its mid-range Galaxy A series in markets like India. Competitors, including Xiaomi, have also issued public warnings anticipating higher price points across both their entry-level and premium smartphone portfolios throughout the year.

However, the industry context does not entirely absolve Samsung of responsibility for the negative perception surrounding the S26. The preceding few generations of the Galaxy S series have been widely characterized by critics and consumers alike as being overly conservative in hardware evolution. If Samsung had delivered more aggressive, palpable upgrades—perhaps a revolutionary camera sensor overhaul, significant battery technology advancements, or dramatic shifts in industrial design—consumers might exhibit greater tolerance for moderate price increases necessitated by external factors.

The AI Pivot and the Diminishing Hardware Case

Instead, Samsung has heavily invested engineering focus and marketing capital into Galaxy AI capabilities over the last two cycles. While the software suite is undoubtedly innovative, the consumer value proposition for purchasing a brand-new flagship solely for these features is becoming tenuous. A significant portion of the Galaxy AI feature set has been backported to older, already discounted models, diminishing the urgency for consumers to invest in the newest hardware generation purely for software access. While the S26 promises updated silicon optimized for on-device AI processing, the core hardware package—the physical device—has been subject to minimal changes year-over-year. Introducing a price hike atop this hardware stagnation makes the value proposition exponentially harder to defend.

The divergence in pricing strategies between markets further fuels consumer skepticism. The scenario where US buyers, protected by strategic pricing alignments likely tied to carrier incentives and market dominance goals, avoid the price increase, while international customers shoulder the added financial burden, is politically and commercially sensitive. It raises fundamental questions: Are global markets expected to implicitly subsidize Samsung’s protracted competitive maneuver against Apple in the high-stakes North American sector? Furthermore, is this a battle Samsung can realistically win solely through aggressive pricing absorption without committing to more significant, bleeding-edge hardware differentiation in future releases?

Masking the MSRP: The Illusion of Affordability

Samsung possesses established mechanisms to mitigate the immediate shock of a higher Manufacturer’s Suggested Retail Price (MSRP). The perennial reliance on aggressive carrier subsidies, inflated trade-in valuations, and time-sensitive launch promotions serves as an effective smokescreen. For consumers opting for a two- or three-year carrier contract, the tangible impact of the elevated MSRP can be effectively deferred or entirely obscured by monthly payment plans.

Yet, these financial engineering tactics do not alter the fundamental economic reality or the inherent value proposition of the device itself; they merely delay the realization of the full cost. This reality hits the most exposed consumers the hardest: international buyers, particularly those who prioritize purchasing unlocked devices directly from retailers. These consumers face the unvarnished, higher price tag immediately.

The predicament facing the Galaxy S26 is multifaceted. It is not simply the fact that the price is rising—a predictable outcome in the current component market. The critical issue is the simultaneous delivery of a higher price tag alongside an allegedly stagnant hardware package, a potentially bifurcated processor strategy (Exynos vs. Snapdragon), and pronounced regional inequity. This convergence of factors compels a significant portion of the potential global audience to pause and critically re-evaluate their purchasing decision, demanding a clear, compelling answer to the question: What tangible technological leap justifies this increased cost in the Galaxy S26 generation? Without a definitive answer embedded in the hardware, the value proposition risks being perceived as fundamentally broken.

Future Impact and Strategic Realignment

The market reaction to the S26 pricing strategy will undoubtedly influence Samsung’s strategic planning for the next several years. If international sales volumes falter significantly, it will serve as a potent indicator that the era of incremental hardware upgrades coupled with inflationary pricing is reaching its consumer tolerance limit outside of the highly subsidized US ecosystem.

Industry analysts suggest that this situation forces Samsung to confront several long-term strategic imperatives. First, achieving true feature parity and performance superiority with the Exynos line is no longer optional; it is essential for maintaining global brand equity and simplifying supply chain management. If the Exynos 2600 cannot definitively outperform or match the Snapdragon counterpart in real-world efficiency and sustained performance, the regional fragmentation will continue to be a significant liability, especially when coupled with a higher price.

Second, Samsung must accelerate its hardware innovation cycle. Relying on software enhancements like Galaxy AI, while strategically sound for ecosystem lock-in, cannot perpetually serve as the primary justification for flagship upgrades when the silicon and camera hardware remains largely static. Future flagship releases will likely require more substantial leaps in display technology, battery density, or core camera sensor performance to command higher prices successfully.

Finally, the handling of regional pricing will set a precedent. If the US market remains insulated while other major regions absorb component cost increases, it risks alienating loyal international customer bases who feel undervalued compared to their American counterparts. This tension between maintaining competitive US market share—often subsidized by higher margins elsewhere—and fostering global customer loyalty will be a defining challenge for Samsung’s executive team throughout 2026. The initial reception to the S26 launch metrics will provide a critical barometer of whether this aggressive cost management strategy successfully navigated the RAM crisis or simply alienated a significant segment of its most dedicated, unlocked-device purchasing consumers. The company’s ability to pivot quickly based on this feedback will determine the long-term health of its premium smartphone segment against increasingly aggressive competition from both established rivals and emerging players leveraging aggressive pricing models.