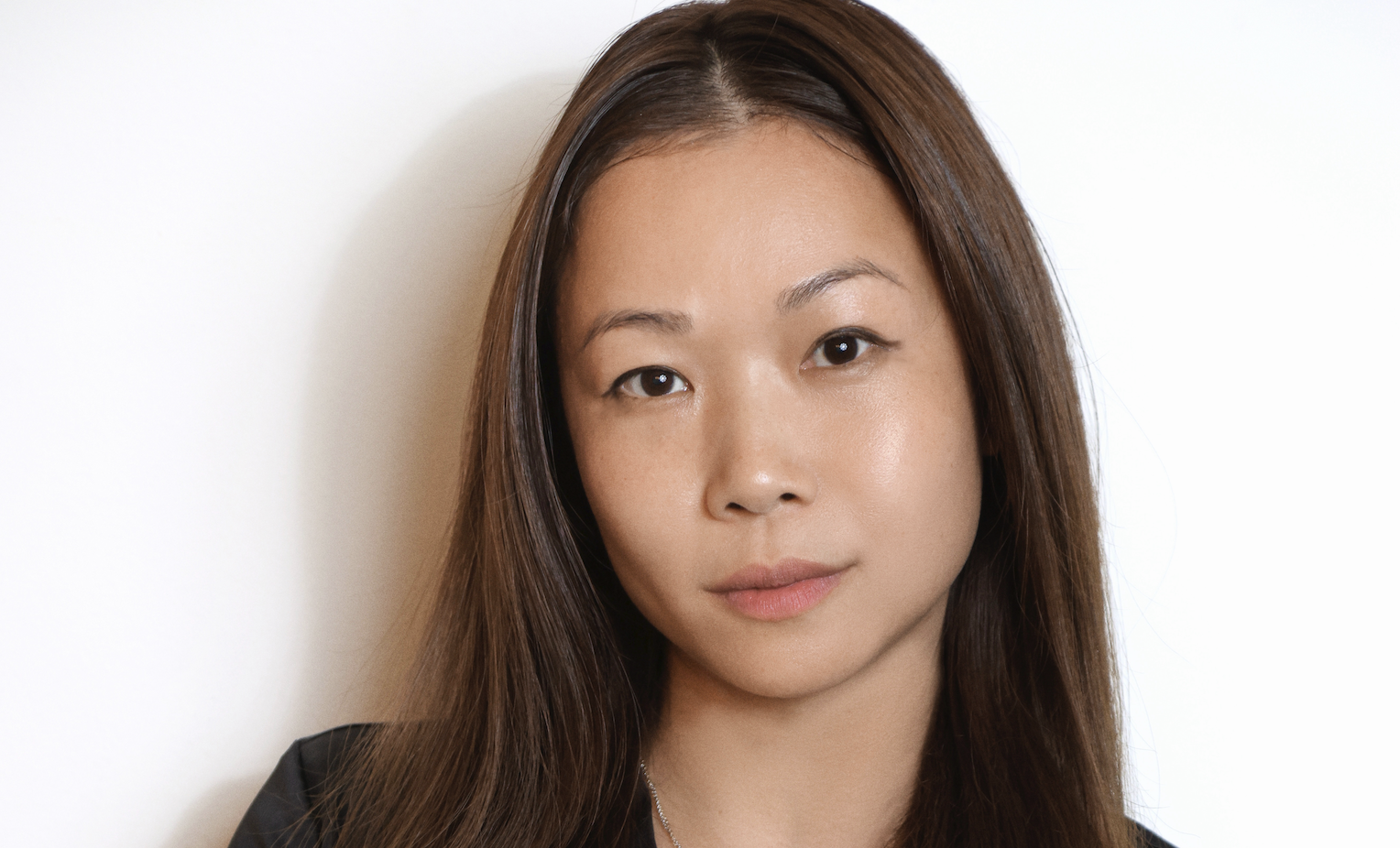

The confluence of behavioral health awareness, personalized technology, and shifting consumer spending priorities has propelled the wellness sector into a multi-trillion-dollar global industry, attracting specialized venture capital attention. In a significant move highlighting this trend, Jenny Liu, the former chief executive officer of the highly exclusive, celebrity-favored gym Dogpound, has successfully closed her debut fund, Crush It Ventures, securing $5 million in commitments for early-stage investments in the expansive wellness ecosystem. This launch is not merely an entry into the competitive venture market; it is strategically positioned to capitalize on two major market inefficiencies: the booming, yet fragmented, demand for holistic well-being solutions, and the persistent capital gap facing underrepresented founders in the space.

The Genesis of a Specialized Thesis

Liu’s transition from operating a premium, high-touch fitness brand to managing an early-stage venture fund is rooted in observations gained from a decade within the epicenter of aspirational health culture. During her tenure, which included two years as CEO and a prior role as CFO following an initial angel investment, Liu gained intimate knowledge of how to cultivate a powerful brand identity and scale experiential businesses. This experience revealed a dual motivation for establishing Crush It Ventures.

Firstly, Liu noted the constant innovation occurring organically within the community spaces she frequented. The wellness sector, she posits, is inherently collaborative, driven by founders—many of whom are deeply passionate practitioners—who continually iterate on products and services ranging from biofeedback technology to specialized hospitality concepts. This environment provided a continuous, real-time deal flow and validation mechanism often inaccessible to traditional, generalist VC firms.

Secondly, and more critically, Liu identified a systemic impediment to growth: the disproportionate difficulty women and minority founders face in securing seed capital. Despite the wellness consumer base being heavily influenced by diverse demographics, access to established founder networks and institutional capital remains concentrated. Crush It Ventures was founded specifically to bridge this funding chasm, supporting businesses that often possess high brand affinity and authentic community engagement but lack the initial financial backing to scale.

Crush It Ventures will deploy capital across a broad mandate within the holistic wellness spectrum, encompassing mental health technology, performance fitness and sport optimization, specialized beauty and longevity solutions, and experiential hospitality focused on restoration and connection. The recent announcement confirms the final close of Fund I at $5 million, earmarking capital for pre-seed and seed-stage investments designed to propel these purpose-driven enterprises.

Analyzing the Wellness Economy’s Meteoric Rise

To understand the strategic potential of Crush It Ventures, one must first grasp the sheer scale and rapid evolution of the contemporary wellness market. While definitions often overlap with the traditional healthcare sector (e.g., sleep science, body health diagnostics), the consumer-driven wellness economy is now defined by elective, preventative, and lifestyle-enhancing expenditures.

Data underscores the massive shift in consumer priorities. According to recent macroeconomic studies, annual spending on wellness in the United States alone exceeds $500 billion. This exponential growth is not uniformly distributed across demographics but is heavily concentrated among younger generations who have fundamentally redefined "health."

The rise of Gen Z as a dominant economic force is central to this trend. Unlike previous generations who often viewed health through a purely clinical lens, younger consumers prioritize mental, emotional, and social well-being alongside physical fitness. The open discourse surrounding burnout, mental resilience, and the search for authentic community has translated directly into purchasing power. While Gen Z constitutes approximately 36% of the adult U.S. population, they are responsible for an outsized 41% of total wellness spending. This contrasts sharply with individuals aged 58 and older, who represent 35% of the population but account for only 28% of wellness expenditures. This generational divergence signals a fundamental, sustained re-allocation of discretionary income toward holistic self-care.

Liu articulates this shift not just as a trend, but as a cultural imperative driven by increasing technological automation. As daily life becomes more digitized, consumers actively seek tangible experiences and products that foster genuine human connection and long-term well-being. "It’s a reflection of shifting values," Liu noted. "Younger generations are actively seeking purpose-driven brands and deeply craving real community interaction." This craving manifests in phenomena such as the explosive popularity of organized run clubs and the transformation of traditional gyms into curated, social hubs—a model Liu successfully mastered at Dogpound.

The Dogpound Advantage: Scaling Brand and Community

Liu’s background provides Crush It Ventures with a critical, non-traditional advantage in the VC landscape: a profound understanding of brand architecture in the experiential economy. The Dogpound model, known for its exclusivity and influential client base, was built on the principle that fitness is a shared experience, not merely a transaction.

"I learned that brand building is not just about marketing a product or service, but about creating a space for shared experiences, joy, and genuine connection," Liu reflected. This insight is invaluable for early-stage wellness companies, where authenticity and community resonance often dictate success far more than simple utility. Crush It Ventures aims to leverage this operational expertise, actively partnering with founders to fortify their brand narratives and community infrastructure as they navigate scaling challenges.

The fund’s investment strategy reflects a commitment to concentrated, impactful early bets. Crush It plans to write initial checks typically ranging from $100,000 to $250,000, targeting a portfolio of 20 to 25 companies over the next 12 to 18 months. This selective, high-conviction approach is crucial for early-stage funds seeking to maximize influence despite limited initial capital.

The portfolio already showcases the breadth of the fund’s focus, including investments in Elemind, a wearable technology company focused on neuroscience and brain health optimization, and Caliwater, a consumer packaged goods (CPG) business emphasizing functional hydration. These early investments demonstrate an appreciation for the convergence of cutting-edge technology (wearables, bio-hacking) and highly scalable, community-adjacent consumer products.

Navigating the Challenging VC Environment

Launching a new fund in the current venture climate presents formidable challenges, particularly for a solo female General Partner (GP). The fundraising environment, characterized by macroeconomic caution and tightening institutional budgets, has led to a pronounced concentration of capital flow toward established, top-tier firms. New managers, especially those focused on niche sectors, often face heightened scrutiny from Limited Partners (LPs).

Liu initiated the fundraising process in 2024, navigating what she described as a "cautious" market. However, the dedicated focus on wellness, coupled with a strong mission statement addressing diversity and access, proved compelling. Liu strategically leaned into her extensive network, built over years in banking and the high-profile fitness world, to secure commitments. While the LPs remain undisclosed, Liu noted a growing appetite, particularly among institutional investors, for "more diverse, mission-driven funds" that promise both financial returns and positive social impact.

The successful closure of Fund I at $5 million, while modest by mega-fund standards, represents a significant victory in the current capital climate, validating the strategic niche carved out by Crush It Ventures. It signals institutional recognition that wellness—viewed holistically—is a resilient and rapidly expanding asset class. Furthermore, the emphasis on backing underrepresented founders aligns with a broader industry trend among LPs seeking to diversify their capital allocation and support managers who possess unique, community-level insights.

Future Impact and Investment Trends

The long-term impact of funds like Crush It Ventures lies in their ability to identify and scale the next generation of wellness giants before they reach the saturation point of generalist investors. Liu’s thesis suggests that the future of wellness will revolve around three interconnected pillars: personalization, preventative care through technology, and the creation of "third places"—physical or digital spaces that foster community outside of home and work.

1. Personalization and Bio-Wearables: The investment in companies like Elemind underscores a belief in the rapid integration of advanced bio-sensing technology into daily life. Future wellness capital will increasingly flow into diagnostics, personalized nutrition (including microbiome science), and non-invasive mental state modulation devices. The goal is to shift consumers from reactive health management to proactive, data-driven optimization.

2. The Mental Health Infrastructure: While mental health apps saw a boom during the pandemic, the current trend favors solutions that integrate mental well-being into everyday routines and community structures, moving beyond siloed therapy. This includes platforms focused on corporate burnout prevention, emotional intelligence training, and highly accessible, low-barrier digital support networks. Crush It’s focus on mental health acknowledges that psychological resilience is the foundation of holistic wellness.

3. Experiential Longevity and Hospitality: The concept of "wellness hospitality" is evolving from simple spa treatments to integrated, science-backed retreats and social clubs centered on longevity protocols. These enterprises blend high-end service with clinical-grade health optimization, creating premium experiences that Gen Z and Millennials are willing to pay a premium for. Liu’s expertise in building the high-touch, exclusive environment of Dogpound positions the fund perfectly to evaluate and scale these experiential models.

By focusing on community-driven and purpose-led ventures, Crush It Ventures aims not only to generate substantial returns but also to fundamentally alter the demographic profile of successful founders in the wellness sector. The mandate is clear: "We want to help close the gap in wellness funding for underrepresented founders, build stronger founder networks, and show that purpose and community-driven companies can scale and make a meaningful difference in health and lifestyle," Liu concluded.

The $5 million Fund I represents a pivotal entry point for Jenny Liu into the venture ecosystem, armed with a deep operational playbook from the fitness elite and a clear vision for the democratized, tech-enabled, and emotionally intelligent future of health. As capital deployment accelerates over the coming months, Crush It Ventures is poised to be a significant architect in shaping the next wave of disruptive wellness platforms, proving that brand, community, and capital accessibility are the keys to unlocking this half-trillion-dollar market.