The proliferation of orbital assets has fundamentally transformed Earth Observation (EO) from a niche, government-dominated field into a burgeoning commercial market. With thousands of satellites now capturing vast quantities of imagery and sensor data in near real-time, the challenge has shifted dramatically: it is no longer about acquiring the data, but rather about efficiently translating that raw stream into immediate, actionable intelligence. Austin-based startup SkyFi has successfully positioned itself at this crucial nexus, a strategic placement underscored by the recent closure of an oversubscribed $12.7 million Series A funding round.

SkyFi operates a platform designed to streamline the notoriously cumbersome process of procuring and utilizing geospatial data. By aggregating supply from over 50 geospatial imagery partners, the company has created what CEO Luke Fischer describes as the largest "virtual constellation" of assets globally. This aggregation model serves as a centralized hub—analogous to a high-fidelity, industrial-scale "Getty Images"—that drastically simplifies access for clients across finance, defense, insurance, and infrastructure sectors.

However, the real driver of investor interest and customer growth is the platform’s evolution beyond simple data provision. As Fischer articulated, the core goal is delivering "answers" rather than just pixels. "Imagery is a commodity, or it’s closely becoming a commodity," he noted, emphasizing that competitive advantage hinges not just on the speed of delivery, but critically, on the "speed of delivery of answers to customers."

This focus on automated analytics and derived insights—available through SkyFi’s website and mobile application—is what propelled the successful Series A. Crucially, the platform also offers users the ability to "task" satellites, directing specific orbiting assets to capture fresh imagery of a designated location at a precise time, thereby providing unparalleled timeliness and customization in the commercial EO market.

Strategic Investment Reflects Dual-Use Market Maturity

The composition of the investment round speaks volumes about the perceived market trajectory of SkyFi. The Series A was co-led by Buoyant Ventures, a fund focused on climate technology, and IronGate Capital Advisors, which specializes in dual-use companies—those serving both commercial and government/defense sectors. This pairing highlights the company’s relevance across global environmental monitoring and national security applications.

Further strategic investors included DNV Ventures, the investment arm of the 160-year-old maritime classification society DNV; Beyond Earth Ventures, a firm dedicated to the space economy; and TFX Capital, known for its extensive defense-related space investments. This diverse consortium underscores a market consensus that the future of geospatial intelligence lies in easily digestible, domain-specific insights, rather than merely raw data feeds.

The initial fundraising target was set modestly at approximately $8 million, according to Fischer, who co-founded the company with Bill Perkins, a veteran of the hedge fund world whose background informs the emphasis on generating quantifiable, actionable insights for financial modeling. However, the unexpected surge in investor demand, particularly following 2025’s record year for defense technology investments, caused the company to repeatedly increase its target, first to $10 million, then $12 million, culminating in the final $12.7 million figure after securing commitment from key strategic partners like DNV.

The Analytical Bottleneck in the New Space Economy

To fully appreciate SkyFi’s market opportunity, one must understand the current dynamics of the New Space ecosystem. The last decade has witnessed a revolution in launch capabilities and satellite manufacturing, driving down costs and enabling the deployment of massive constellations of small satellites (CubeSats) and advanced sensor platforms. Companies like Planet, Maxar, and Airbus have successfully established the infrastructure for persistent, global data collection.

However, this proliferation created an inherent challenge: data saturation. Enterprises and government agencies found themselves drowning in petabytes of raw imagery, often lacking the in-house expertise, computational resources, or specialized Geographical Information Systems (GIS) software required to extract value efficiently. The traditional pipeline for satellite data—involving complex APIs, specialized formats, lengthy processing times, and reliance on highly trained remote sensing analysts—acted as a significant bottleneck, restricting the use of EO data to a small, specialized user base.

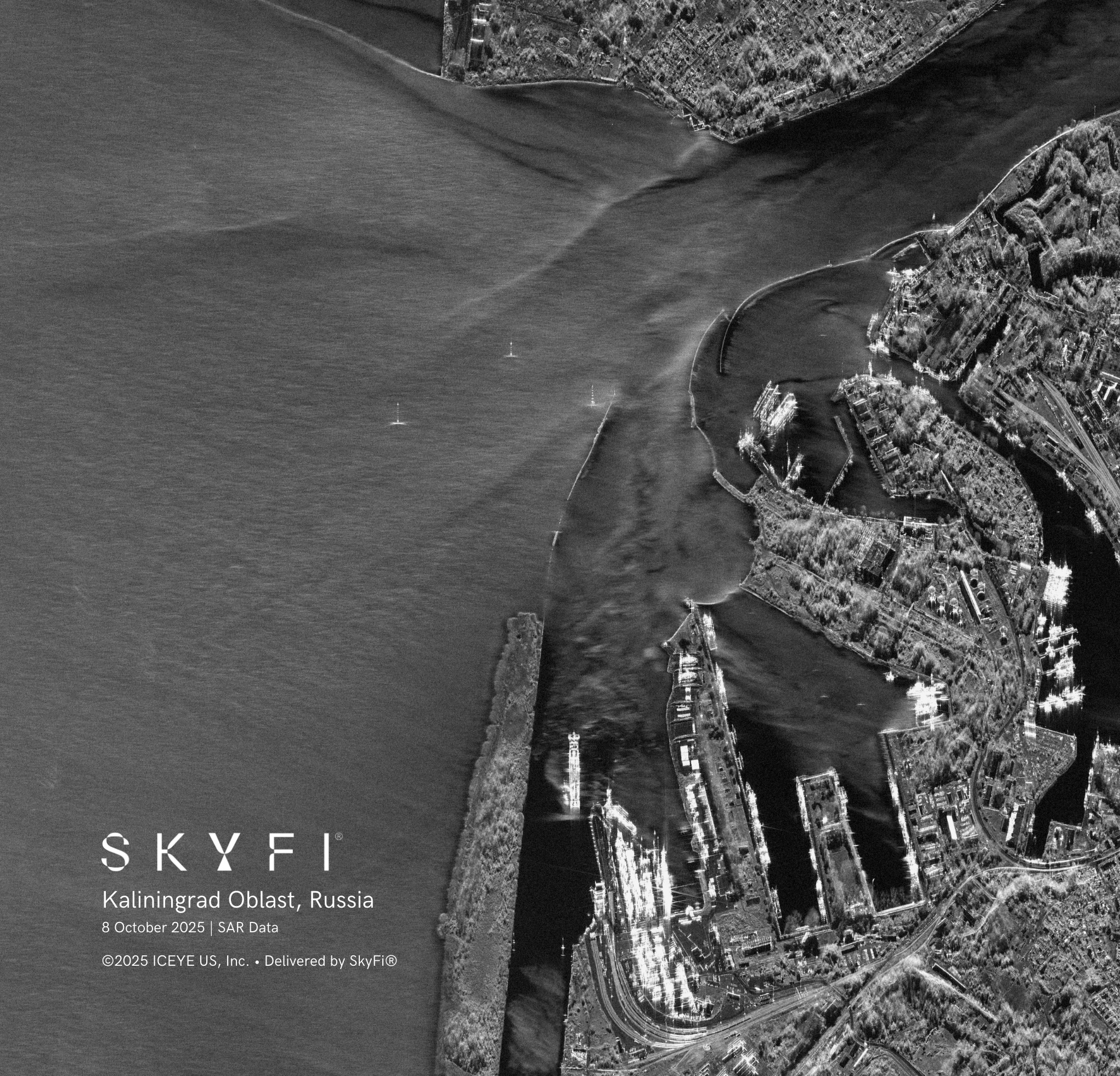

SkyFi’s approach bypasses this bottleneck entirely. By acting as the aggregation layer and, critically, the analytical layer, it transforms the data access paradigm. Fischer noted that the company’s ability to onboard new data providers has shifted from being a complex negotiation to being "table stakes." This signifies market acceptance of the aggregator model. With the "largest virtual constellation of assets" and access to all different sensor types—including electro-optical, Synthetic Aperture Radar (SAR), and potentially hyperspectral—SkyFi’s strategic moat is not the hardware, but the intelligence derived from the aggregated data streams.

Software-First Strategy and the Power of the Feedback Loop

A crucial competitive advantage for SkyFi is its software-first operational model. Unlike many competitors that bear the immense capital expenditure (CAPEX) burden of owning, launching, and maintaining their own constellations, SkyFi leverages the investments made by its 50+ partners. This asset-light approach allows the company to rapidly scale its analytical capabilities without being constrained by hardware replacement cycles or the geopolitical risks associated with proprietary constellations.

Fischer draws parallels between SkyFi’s data utilization model and his previous experience helping lead Uber’s Elevate division. Uber leveraged mobility data—where people move and what services they request—to layer in new products like bikes, scooters, and drone delivery. SkyFi applies this same principle to geospatial intelligence.

"We have that equivalent data on what people are looking at in the world [and] what they’re asking of that data," Fischer explained. This constant stream of customer requests—the metadata surrounding why a customer tasks a satellite or requests an analytical report on a specific area—creates an invaluable, self-reinforcing feedback loop. This intelligence allows SkyFi to preemptively identify high-demand analytical offerings, refine its machine learning algorithms, and build scalable solutions that address proven market needs for both government and commercial entities.

This deep understanding of user demand allows SkyFi to shift the focus away from simply selling data volume and toward selling automated solutions. While sophisticated clients, such as quantitative hedge funds, often prefer to ingest raw data for proprietary analysis, the vast majority of the expanding user base is increasingly interested in ready-made insights delivered with minimal latency.

Industry Implications: Democratizing Geospatial Intelligence

The implications of platforms like SkyFi extend far beyond simple efficiency improvements; they represent the democratization of advanced geospatial intelligence.

1. Mainstreaming Geospatial Applications: Traditionally, accessing and analyzing satellite imagery was restricted to specialists. By packaging tasking and analytics into an accessible website and mobile app—a usability so intuitive that Fischer mentions his teenage daughters use the platform for college homework—SkyFi is breaking down technological barriers. This dramatically expands the total addressable market (TAM) from a niche community of GIS experts to everyday business analysts, supply chain managers, climate researchers, and first responders.

2. Climate and ESG Monitoring: The involvement of Buoyant Ventures underscores the critical role EO data plays in Environmental, Social, and Governance (ESG) reporting and climate resilience. Accessible, high-frequency satellite monitoring enables precise measurement of carbon fluxes, deforestation rates, water stress, and infrastructure integrity following extreme weather events. This capability is becoming mandatory for large corporations seeking to meet regulatory and investor demands for transparent climate reporting.

3. Defense and Dual-Use Acceleration: The strong presence of defense-focused investors (IronGate, TFX Capital) confirms the platform’s value in the dual-use technology sphere. In defense and national security, speed and accuracy are paramount. SkyFi’s ability to rapidly task diverse sensor types across a large virtual constellation provides immediate tactical and strategic awareness. This supports applications such as maritime domain awareness, tracking troop movements, and monitoring critical infrastructure globally, satisfying the accelerating demand for commercial intelligence sources to augment government systems.

4. The Future of Analytical Automation: The new funding will be directed toward scaling these analytical offerings. The next evolution of the platform will rely heavily on advanced Artificial Intelligence (AI) and Machine Learning (ML) models to automate the interpretation of imagery. For instance, rather than a customer requesting an image of a port, they can request an automated report on the change in container volume over the last month, or an assessment of construction progress on a specific site. This automation moves the product higher up the value chain, shifting the relationship from a data vendor to a decision support system.

Forward Outlook: The Velocity of Insight

The $12.7 million capital injection validates SkyFi’s position as a critical middleware layer bridging the rapidly expanding supply of orbital data with the accelerating demand for intelligence. The focus on being "software first" and leveraging a deep understanding of customer behavior—derived from its request feedback loop—positions the company favorably against legacy providers saddled with heavy infrastructure costs.

The future of Earth Observation is defined by velocity: the speed at which data moves from orbit to decision-maker, and the speed at which raw data is transformed into meaningful insight. As Luke Fischer and the SkyFi team scale their analytical engines and expand the breadth of their virtual constellation, they are not just selling images; they are fundamentally selling time, accuracy, and, most importantly, the actionable answers that underpin global commerce and security in the 21st century. The democratization process is fully underway, making satellite-derived intelligence accessible, affordable, and, perhaps most notably, a standard tool in the modern professional toolkit.