The digital communication landscape is undergoing a fundamental shift, moving away from the purist model of completely free, ad-free services towards a spectrum of paid tiers designed to cater to varying user tolerances for commercial intrusion. For over a decade, WhatsApp has stood as a fortress of end-to-end encrypted, distraction-free messaging, leveraging its massive global user base—now numbering well over two billion—as its primary strategic asset. This commitment to simplicity and privacy, however, appears to be gradually eroding under the increasing monetization pressures facing its parent company, Meta Platforms, Inc. Recent deep-dive analysis into the application’s code reveals compelling internal scaffolding for a subscription service aimed at removing advertisements from newly introduced features, marking a significant pivot in the platform’s long-standing operational philosophy.

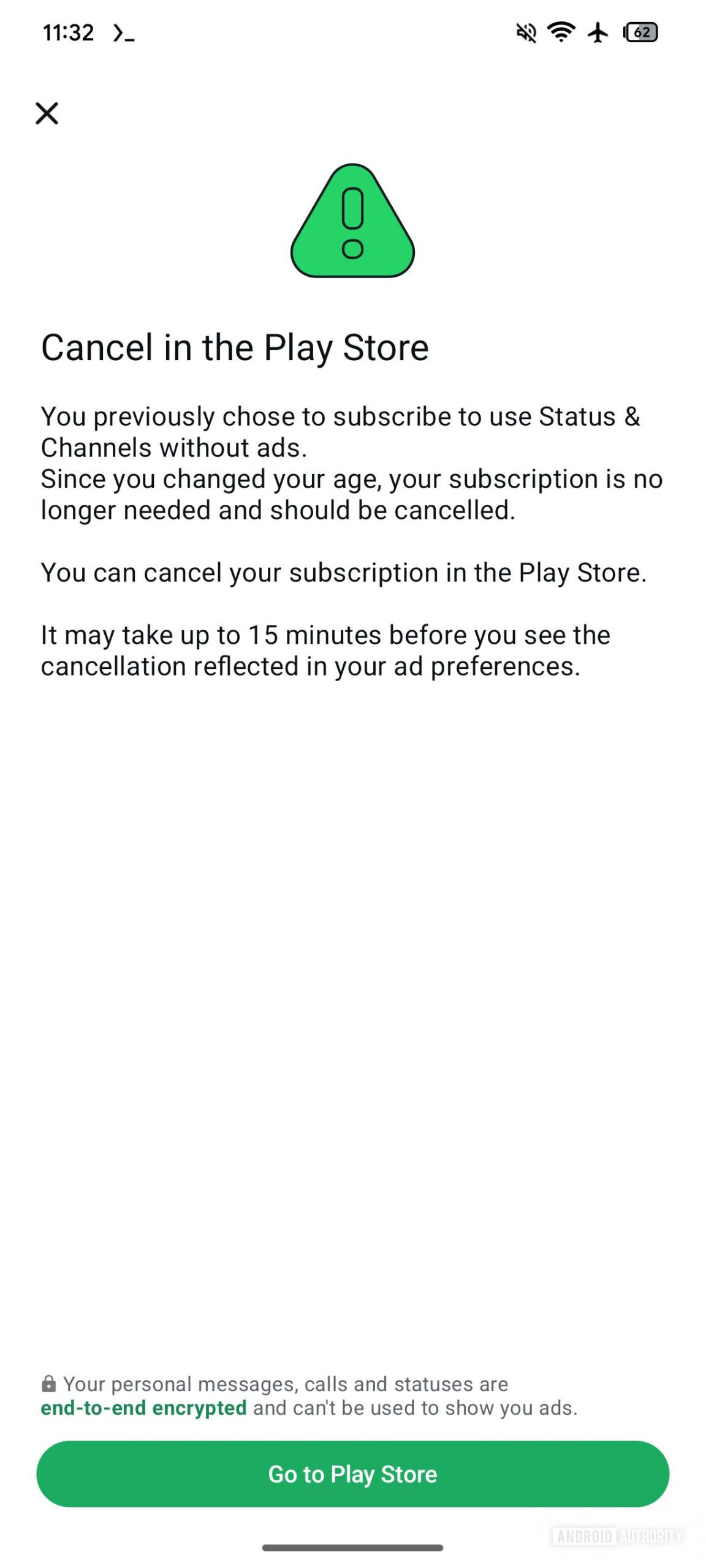

This discovery, stemming from a forensic examination of the latest iteration of the WhatsApp application (version 2.26.3.9), points directly toward the imminent arrival of a paid offering. This evidence is not abstract; it manifests in concrete text strings and demonstrable interface prompts within the beta build, suggesting that Meta is far beyond the conceptual phase and is actively engineering the infrastructure for premium access. Specifically, the code references subscription management tied directly to the removal of ads within the Status feature and the nascent Channels functionality.

The Context: Monetization Creep and User Backlash

WhatsApp’s initial integration of advertising began quietly, focusing on the Status tab—a feature conceptually similar to Instagram Stories—which many users already treat as a secondary content consumption area. This move was met with predictable user resistance. In the digital ecosystem, WhatsApp has long been the gold standard for secure, personal communication, and the introduction of commercial content feels jarringly out of place. Unlike platforms like Facebook or Instagram, where ads are embedded within the core feed experience, WhatsApp’s value proposition has historically been its near-total exemption from commercial noise.

The friction caused by these initial advertisements is crucial context for understanding the significance of the subscription findings. When Meta first began testing these ads, the community reaction was swift and largely negative, reinforcing the perception that Meta was sacrificing user experience for short-term revenue gains. Introducing a paid escape hatch is a strategic maneuver designed to mitigate this backlash. By offering users a choice—tolerate the ads or pay to eliminate them—Meta attempts to segment its user base: those willing to pay for an enhanced experience, and those who will remain on the ad-supported free tier.

The code snippets uncovered are highly specific. One string details the repricing of a subscription following the removal of a linked Accounts Center profile: "Since you recently removed your WhatsApp account from your Accounts Center, the price of your subscription for no ads in Status & Channels has decreased. Review your subscription to accept the new price of %1$s/month; or choose to use Status & Channels free of charge with ads." This language confirms several critical elements: the subscription is monthly, it targets Status and Channels specifically, and it explicitly contrasts the paid, ad-free experience against the free, ad-supported alternative. Furthermore, the reference to the Accounts Center—Meta’s unified login system linking Facebook, Instagram, and WhatsApp—suggests this subscription management will be deeply integrated into the broader Meta ecosystem controls.

Industry Implications: The Subscriptionization of Communication

The potential introduction of a paid, ad-free tier for WhatsApp has significant ramifications that extend far beyond Meta’s messaging application. It signals a maturing, and perhaps desperate, phase in the "free-to-use" internet model, particularly for large, established platforms.

1. Normalization of Premium Messaging: If WhatsApp, the world’s most popular messaging app, successfully implements a paid subscription for basic feature enhancement (ad removal), it further normalizes the concept of paying for core functionality across the entire tech sector. We have seen this trend with Twitter/X’s premium verification and content promotion features, and with Telegram’s Premium tier offering enhanced capabilities. WhatsApp’s model, however, is unique because its primary value is absence—the absence of ads and tracking within private conversations. Paying to restore that original state of absence is a novel, yet potentially lucrative, proposition.

2. The Two-Tiered User Experience: This move solidifies a bifurcation in user experience. The free tier will become increasingly crowded with commercial content, potentially degrading performance or usability to push users toward the subscription. The paid tier, conversely, secures the platform’s original appeal: a clean, private space. For high-value users or businesses that rely heavily on WhatsApp for professional communication, the subscription may quickly become a necessary operational expense rather than a luxury feature.

3. Revenue Diversification for Meta: Meta’s primary revenue stream remains advertising across Facebook and Instagram. However, regulatory pressures, changes in privacy standards (like Apple’s App Tracking Transparency), and market saturation mean relying solely on targeted ads is increasingly risky. Introducing a stable, recurring subscription revenue stream from WhatsApp—which commands unprecedented daily engagement—provides essential financial ballast and diversification, potentially insulating the company against future ad market volatility.

Expert Analysis: The Calculus of Value

From a product development perspective, the decision to monetize Status and Channels first is highly calculated. Private one-to-one chats and group chats remain sacrosanct, protected by end-to-end encryption and regulatory scrutiny; monetizing these directly is currently untenable. Status and Channels, however, are public or semi-public broadcast features, making them ideal initial targets for advertising insertion.

The introduction of a paid tier suggests Meta has modeled the expected churn rate versus the anticipated subscription uptake. If the user base is large enough, even a small percentage converting to paid subscribers can generate billions in annual recurring revenue (ARR). Analysts will be closely watching the conversion rate, as it sets the benchmark for how Meta monetizes its other non-advertising-rich platforms.

Furthermore, the code references a potential price point: "%1$s/month." While the exact figure is obfuscated, the structure implies a standardized, fixed monthly fee. Given Meta’s existing pricing for ad-free Instagram/Facebook subscriptions in Europe (around €9.99 or $13/month), it is reasonable to anticipate WhatsApp’s ad-free tier will be priced competitively, likely hovering in the mid-single digits to ensure mass appeal while still representing a tangible revenue source.

The detail regarding the Accounts Center linkage suggests a significant technical integration. If a user unsubscribes from the ad-free service on Instagram, that action might automatically trigger a review or downgrade notification within WhatsApp, reinforcing the unified nature of Meta’s identity management and subscription services. This interconnectedness aims to maximize the lifetime value of a Meta user, encouraging them to remain within the ecosystem, whether free or paid.

Future Impact and Trends: Beyond Ad Removal

While the immediate focus is on removing ads from Status and Channels, this infrastructural groundwork lays the foundation for more expansive subscription offerings. Once the subscription framework is robust, Meta has several avenues for future expansion:

1. Premium Features: The ad-free tier could evolve into a "WhatsApp Premium" offering, incorporating features currently reserved for Business Accounts or those that require significant computational resources. This could include higher limits on file transfers, expanded cloud backup options (beyond what is currently offered via Google Drive/iCloud), enhanced customization options, or perhaps even priority customer support.

2. Content Integration and Creator Tools: If Channels become a significant source of content discovery, Meta could introduce subscription tiers specifically for exclusive content from verified creators or businesses operating within Channels. This would position WhatsApp not just as a communication tool, but as a legitimate content distribution platform competing with platforms like Substack or Patreon, leveraging its existing user base.

3. Cross-Platform Bundling: The most potent long-term impact lies in bundling. Meta could offer a compelling, unified "Meta Pro" subscription that includes ad-free experiences across Facebook, Instagram, and WhatsApp, along with shared access to advanced features. This strategy locks users into the entire suite of Meta products, making the cost of switching providers exponentially higher.

The engineering effort visible in version 2.26.3.9 suggests that Meta views the monetization of WhatsApp as an inevitability, rather than an option. The current implementation appears to be a soft entry—a trial balloon to gauge user acceptance of paying for the removal of ads from non-core features. Should this rollout prove successful, the era of WhatsApp as a purely non-commercial application will officially draw to a close, ushering in a new financial paradigm for the world’s leading encrypted messenger. The coming months will reveal whether users prioritize the nominal cost of subscription over the erosion of the platform’s defining characteristic: its pristine, uninterrupted user experience. The internal code serves as a clear notification that Meta is ready to charge for silence.