The recent barrage of rumors surrounding OnePlus—culminating in sensationalized reports of a potential corporate dismantling—has sent ripples of concern across the global technology sector, particularly within the Android ecosystem. While the company has issued formal denials, labeling the most extreme claims as "false" and "misleading," the context surrounding these statements suggests a deeper operational turbulence that warrants rigorous scrutiny from industry analysts and consumers alike. The official clarification, notably focused on maintaining after-sales support, pointedly omitted assurances regarding the continuity of future product pipelines, leaving a strategic vacuum ripe for speculation.

This period of ambiguity follows a string of concerning internal indicators. Early whispers suggested the abrupt cancellation of highly anticipated hardware, specifically the rumored OnePlus Open 2 foldable and the mid-cycle refresh, the OnePlus 15s. Such cancellations, if substantiated, signal significant strategic pivots or, more ominously, acute internal pressures that could necessitate resource reallocation or restructuring. Furthermore, reports hinted at a scaled-back global rollout for the expected flagship iteration, the OnePlus 16, suggesting a deliberate constriction of market footprint rather than aggressive expansion. When aggregated, these disparate data points paint a picture far more complex than a simple denial can resolve, compelling observers to analyze the foundational importance of OnePlus to the broader mobile landscape.

Historical Context: From Flagship Killer to Established Contender

To fully appreciate the gravity of these whispers, one must recall OnePlus’s meteoric rise. Launched in 2014, the brand carved out an almost unprecedented niche: the "flagship killer." By offering specifications that rivaled established giants like Samsung and Apple, but at substantially lower price points, OnePlus forced incumbents to reassess their value propositions. This early philosophy—encapsulated in the rallying cry to "Never Settle"—was a direct catalyst for increased innovation across the Android segment.

OnePlus served as the essential competitive friction required to prevent market stagnation. Its early adoption of high refresh rate displays, epitomized by the groundbreaking OnePlus 7 Pro’s 90Hz panel, pressured competitors to accelerate their own R&D cycles in screen technology. Similarly, the introduction and consistent advancement of proprietary fast-charging technologies—from the initial Warp Charge speeds to the current 100W benchmarks—created a technological arms race. While Apple and Samsung historically prioritized slower, more conservative charging solutions, OnePlus consistently pushed the envelope, forcing the entire industry to address consumer demand for faster power replenishment.

The iconic Alert Slider, a physical hallmark of the brand, represented a commitment to nuanced user experience design that transcended mere software gimmicks. Even as the company navigated integration challenges following its closer alignment with parent company OPPO, these foundational elements defined a distinct, consumer-centric identity. Any erosion of this identity, or, worse, the cessation of its hardware output, represents a significant loss of competitive momentum that the entire Android camp relies upon.

Technological Benchmarks Under Threat

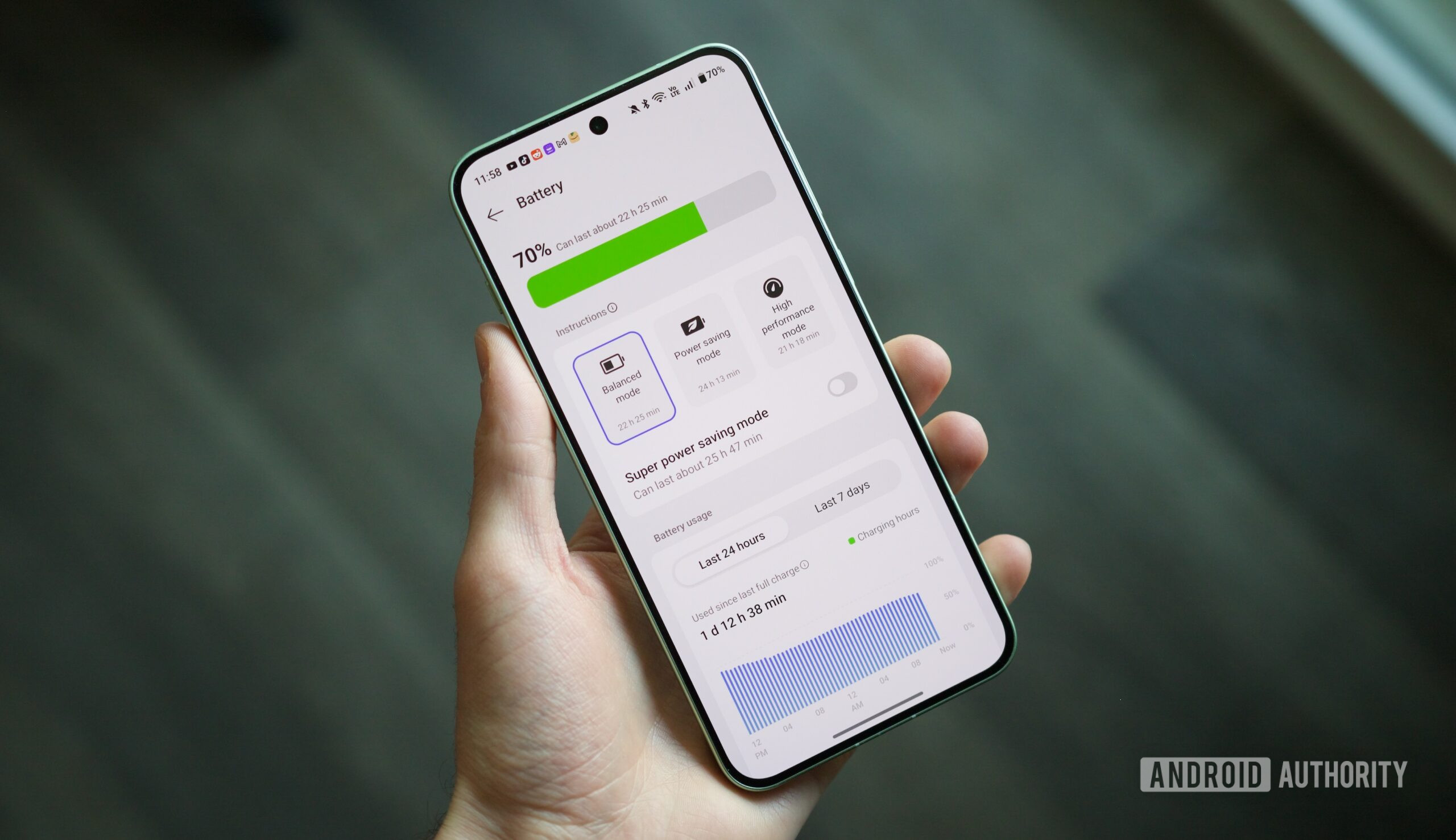

The current product line, despite any internal strife, still demonstrates OnePlus’s commitment to bleeding-edge component integration, particularly in battery technology. The recent OnePlus 15 and 15R models stand out as notable outliers in the US market due to their aggressive adoption of silicon-carbon battery chemistry. This technology promises higher energy density and improved longevity compared to standard lithium-ion cells, yet major US-focused players like Samsung, Google, and Motorola have largely eschewed its implementation in their primary flagships.

OnePlus’s willingness to deploy these large-capacity cells—resulting in 7,300mAh and 7,400mAh capacities, respectively, for the 15 and 15R—is a direct expression of the "Never Settle" ethos. In an era where most premium Android devices hover around the 5,000mAh mark, these capacity figures offer a tangible, real-world benefit to users. The potential withdrawal of a company willing to take such calculated hardware risks suggests a future where incremental, rather than disruptive, innovation becomes the norm for the remaining OEMs.

Industry Implications: The US Market Concentration Crisis

The potential destabilization of OnePlus carries disproportionate weight in the United States market. Unlike European or Asian markets, which benefit from a diverse array of global challengers—including former powerhouses like Huawei, and current innovators like Xiaomi and Vivo—the US landscape is heavily consolidated. The market is effectively a duopoly between Apple and Samsung, with Google and Motorola occupying distant third and fourth positions, respectively.

For consumers seeking a non-Apple alternative, the choice is already constrained. If OnePlus, which frequently offers a compelling blend of high-end specs, competitive pricing, and unique features (like the aforementioned battery tech), were to retract significantly or disappear entirely, the market dynamic would shift dangerously toward oligopoly. A reduction from four major Android contenders (Samsung, Google, Motorola, OnePlus) to three would grant the remaining entities less incentive to aggressively price or innovate outside of their core profit centers.

Expert analysis suggests that the competitive pressure exerted by OnePlus on Samsung’s premium offerings and on Google’s Pixel line is substantial. OnePlus devices often occupy a crucial price-to-performance tier that forces Samsung to offer aggressive carrier deals or compels Google to refine software experience to justify its price premiums. Without this counterweight, the pricing structure for flagship and even upper mid-range Android devices in the US risks becoming insulated from meaningful downward pressure. The vacuum created would likely be filled not by a new, bold entrant—the barriers to entry in the US telecom ecosystem are notoriously high—but by the consolidation of market share among the existing triumvirate.

The OPPO Factor and Strategic Ambiguity

It is impossible to analyze OnePlus’s current state without addressing its relationship with OPPO. Since the formal integration of their core operations, OnePlus has operated under OPPO’s umbrella, sharing technology, supply chains, and, increasingly, software foundations (ColorOS replacing OxygenOS in many regions). The initial rationale for this merger was synergistic: combining OPPO’s manufacturing prowess and supply chain muscle with OnePlus’s brand cachet and software expertise.

However, the current rumors suggest that the internal mechanics of this synergy may be undergoing strain or radical re-evaluation. If the reported cancellations of the Open 2 and 15s are indeed rooted in strategic shifts mandated by the parent company, it implies that the roadmap is being dictated by OPPO’s broader global ambitions, which may no longer align perfectly with the high-risk, high-reward profile OnePlus historically maintained. The vague nature of the North American statement—guaranteeing support but avoiding future product commitment—suggests management is navigating a delicate internal transition, possibly consolidating efforts under the OPPO brand in certain Western markets where brand recognition is higher, or perhaps streamlining the portfolio to focus only on guaranteed high-volume sellers.

This strategic opacity is more alarming than an outright admission of trouble. A definitive statement of restructuring allows for analysis based on known business parameters. Ambiguous denials, however, signal a period of flux where fundamental product decisions are being re-litigated behind closed doors, threatening product cycles that consumers have come to rely on.

Future Impact: Innovation Atrophy and Consumer Choice

Should the current operational headwinds prove terminal for OnePlus’s independent product strategy, the immediate casualties would be in areas where the brand has historically excelled: foldables and high-capacity battery solutions. The OnePlus Open established the brand as a serious contender in the nascent foldable segment, offering a highly refined device that challenged established norms. The cancellation of the Open 2 would effectively remove one of the few serious, globally available Android alternatives to Samsung’s Galaxy Z Fold series. This lack of direct competition in the premium form factor market stifles innovation, as the incentive for Samsung to radically alter its design or pricing strategy diminishes substantially.

Furthermore, the chilling effect on specialized hardware development cannot be overstated. OnePlus’s willingness to test novel battery chemistry—a long-term infrastructure investment—suggests a commitment beyond quarterly earnings reports. If financial prudence dictates shelving such ambitious projects in favor of safer, high-volume components utilized across the broader BBK Electronics portfolio (which includes OPPO and Realme), then the entire ecosystem suffers from a regression toward the mean. The trajectory of Android hardware development risks slowing down, settling into an iterative cycle defined primarily by processor upgrades and marginal camera improvements, rather than fundamental shifts in battery life or form factors.

The longevity of the alert slider itself serves as a micro-example of this broader trend. While not technologically critical, its continued presence was a tangible link to the brand’s heritage. If future iterations eliminate it due to cost-saving or design simplification driven by consolidation, it represents another piece of user-centric differentiation lost to the pursuit of streamlined mass production.

The Imperative for Stability

In conclusion, while OnePlus officially refutes the most dire predictions regarding its immediate cessation, the underlying evidence—product cancellations, strategic ambiguity, and historical context—suggests a significant period of recalibration or decline. For consumers who value technological pluralism and robust competition, the stability of OnePlus is not merely a matter of brand loyalty; it is an essential component of a healthy, dynamic smartphone market.

The industry needs champions willing to push technical boundaries, especially in markets where choices are already scarce. The return to a near-duopoly between Apple and Samsung in the US Android sphere, facilitated by the retreat of a viable challenger like OnePlus, would represent a significant step backward for consumer choice and technological velocity. The hope within the Android community must be that the internal negotiations currently underway lead to a reinforced, rather than dismantled, OnePlus—one that can once again embody its original mission: challenging the status quo and refusing to settle for anything less than the best available technology. The next few product announcements will serve as the ultimate litmus test for the brand’s long-term viability and its commitment to driving forward the entire mobile platform.