The opening weeks of 2026 have decisively demonstrated that the future of mobility is converging rapidly with the next wave of artificial intelligence. The Consumer Electronics Show (CES) in Las Vegas served as a high-fidelity barometer for this shift, revealing a stark contrast between legacy industry players and the emerging technological vanguard. While U.S. legacy automakers continued their pattern of reduced physical presence—a trend first noted prominently last year—the vast exhibition halls of the Las Vegas Convention Center were instead dominated by the architecture of automation: autonomous vehicle developers, sophisticated chip and software companies, and an explosion of robotics anchored by a newly popularized concept: "Physical AI."

Nvidia CEO Jensen Huang, a leading voice in the silicon infrastructure powering this revolution, has championed the term Physical AI, or what is often referred to academically as Embodied AI. This paradigm represents the transition of complex artificial intelligence models out of purely digital environments and into the tangible, physics-constrained world. These systems integrate advanced AI reasoning with real-world sensory input (cameras, lidar, radar) and mechanical outputs (motors, actuators), enabling physical objects—be they robotaxis, industrial drones, autonomous forklifts, or humanoids—to perceive, understand, and autonomously navigate complex, unstructured environments. The omnipresence of this technology across diverse sectors at CES, from advanced agriculture equipment and industrial manufacturing platforms to personal wearables, confirmed its status as the year’s defining technological inflection point.

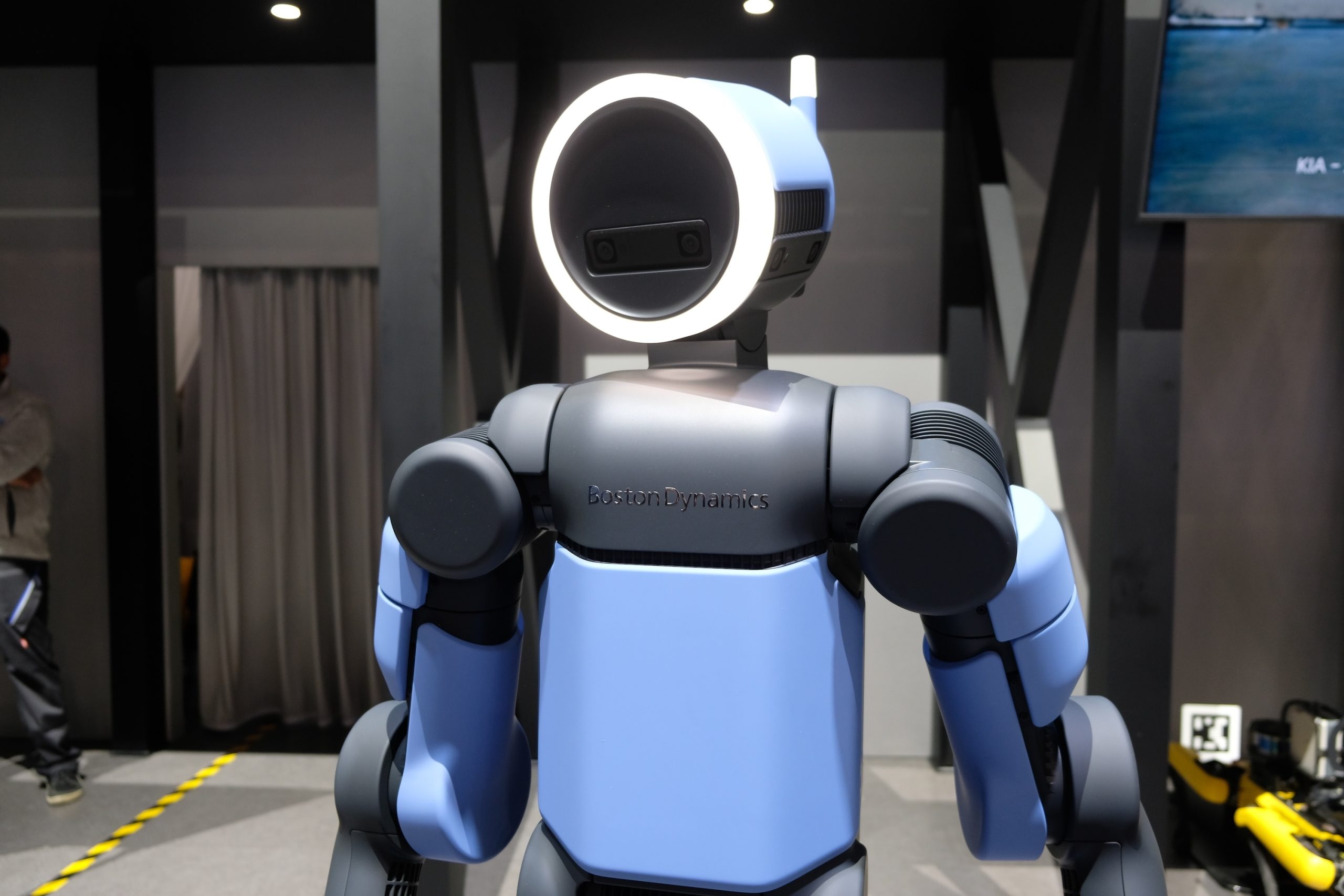

The most visible embodiment of this trend was the relentless focus on robotics, particularly humanoids. The sprawling exhibit space occupied by the Hyundai Motor Group offered a powerful example of this strategic pivot. The Korean conglomerate’s booth, marked by near-constant queues, focused not on new consumer vehicle models, but on its robotics portfolio. Central to this showcase was the latest iteration of the Atlas humanoid robot, a product of its subsidiary, Boston Dynamics, demonstrating advanced dexterity and locomotion. Complementary innovations from the Hyundai Motor Group Robotics LAB included specialized robots for charging autonomous electric vehicles and the Mobile Eccentric Droid (MobEd), a unique four-wheel electric platform slated for production this year. This emphasis signals a profound internal reallocation of R&D resources, treating the traditional automobile business unit as one piece of a much larger, automated transport and logistics ecosystem.

The sheer volume of investment and attention directed toward humanoid robotics has inevitably triggered the classic technology "hype cycle." When questioned about the skepticism surrounding the commercial viability of humanoids, Amnon Shashua, co-founder and president of Mobileye, offered a grounded perspective rooted in historical precedent. Shashua, whose company recently committed $900 million to acquire the humanoid robotics startup Mentee Robotics, drew a parallel to the early internet boom. He argued that the dot-com crash of 2000, while involving spectacular corporate overvaluation and failure, did not invalidate the foundational importance of the internet itself. Similarly, he asserted that while the current enthusiasm may lead to short-term market volatility and overvalued startups, the underlying domain of embodied robotics is fundamentally real and poised to transform global labor and logistics.

The acquisition of Mentee Robotics by Mobileye for a substantial sum underscores the industry’s belief that the AI stacks developed for highly complex autonomous driving (perception, prediction, planning) are directly transferable to general-purpose robots. This cross-pollination is a crucial implication of Physical AI: the foundational software required for a robotaxi to navigate a busy intersection is conceptually similar to what a humanoid robot needs to navigate a factory floor or a human home. Nvidia’s launch of Alpamayo, a suite of open AI models designed to enable autonomous vehicles to achieve human-like cognition, further cements this direction, prioritizing cognitive capability over brute-force mapping and rules-based systems.

Concurrently, the operational side of autonomous mobility is attempting to consolidate and refine its trajectory. Motional, the AV joint venture largely backed by Hyundai, recently completed a critical reboot following a period of operational pause. The company has re-emerged with an explicit "AI-first" mandate, aiming to leverage deep learning and advanced models to accelerate its path to driverless service deployment in 2026. This repositioning highlights the industry-wide consensus that incremental engineering improvements are secondary to breakthroughs in generalized AI capabilities for safe, scalable autonomy. The commitment by Uber, Lucid, and Nuro to introduce a new robotaxi platform also signals the continuous, if often turbulent, progression toward commercializing autonomous passenger and delivery services.

Geopolitical Friction and Market Access

Beyond the technological showcases, significant geopolitical and regulatory currents are reshaping the competitive landscape of the mobility sector, particularly concerning market access in North America. The growing presence of Chinese automakers like Geely and GWM at CES contrasts sharply with the political rhetoric in the United States, where market protectionism remains a dominant theme.

Recent comments by former President Trump at the Detroit Economic Club, suggesting a welcoming stance toward Chinese automakers provided they establish domestic manufacturing plants ("If they want to come in and build a plant and hire you… that’s great, I love that"), immediately triggered consternation among established industry players. Insiders report that the Alliance for Automotive Innovation, the key lobbying body for the domestic auto industry, expressed intense concern over the potential implications of such a policy shift.

The primary obstacle to Chinese market entry is not economic competition alone, but existing US federal law predicated on national security concerns. A 2025 rule issued by the U.S. Department of Commerce’s Bureau of Industry and Security effectively bans the import and sale of connected vehicles and related hardware/software linked to adversarial nations, specifically targeting China and Russia. This measure is designed to mitigate risks associated with data exfiltration and potential remote manipulation of critical transportation infrastructure.

Avery Ash, CEO of SAFE (a nonpartisan organization focused on supply chain security), articulated the profound risk of relaxing these restrictions, even under the guise of attracting manufacturing jobs. Ash warned that welcoming Chinese OEMs to build cars domestically would "reverse hard-won accomplishments" regarding supply chain security, potentially having "catastrophic impacts on our automotive industry" and creating ripple effects across the defense industrial base. The argument centers on the embedded nature of modern vehicle technology; regardless of where the final assembly occurs, the software, telematics, and critical components may still be controlled by entities linked to foreign governments, creating significant long-term vulnerability.

This US cautiousness stands in sharp contrast to the recent policy direction in Canada. Prime Minister Mark Carney’s government announced a dramatic reduction in the import tax on Chinese electric vehicles (EVs) from 100% down to a mere 6.1%. This move instantly positions Canada as a potentially significant entry point for Chinese-made EVs into the North American market, creating intense competitive pressure on US and European manufacturers and potentially forcing a reevaluation of the regulatory perimeter along the US-Canada border.

Market Consolidation and Valuation Realities

The financial activities in the mobility sector reflect a period of both strategic consolidation and painful valuation correction. In the air transport sector, budget airline Allegiant agreed to acquire competitor Sun Country Airlines for approximately $1.5 billion, signaling consolidation in the low-cost travel segment. Meanwhile, infrastructure and enterprise software saw activity, with Dealerware, a provider of automotive OEM and retailer software services, being acquired by a consortium of growth investors, indicating ongoing investment in optimizing the automotive retail lifecycle. Even the long-distance travel market saw consolidation, with Flix acquiring a majority stake in Flibco, a European airport transfer platform, demonstrating the continuing appetite for vertically integrated, multi-modal transport solutions.

In the nascent advanced air mobility (AAM) space, significant capital continues to flow. JetZero, a California startup developing a triangular-winged aircraft design focused on fuel efficiency, secured $175 million in a Series B round, illustrating investor faith in disruptive aerospace designs. Similarly, Joby Aviation, a leader in electric air taxis, expanded its manufacturing footprint by acquiring a large facility in Dayton, Ohio, to support ambitious production targets—doubling output to four aircraft per month by 2027.

However, the lidar sector provided a harsh reality check. Luminar, once a high-flying AV component supplier whose valuation soared to $11 billion in 2021, reached an agreement to sell its core lidar business for just $22 million to Quantum Computing Inc. This drastic collapse in valuation underscores the brutal market dynamics currently affecting specialized hardware providers in the AV space. As the technology matures, commoditization pressures are forcing extreme consolidation, leaving only those with massive scale or truly differentiated technology to survive.

Regulatory and Operational Shifts

Regulatory momentum regarding autonomous technology is accelerating at the state level. New York Governor Kathy Hochul announced plans to introduce legislation that would expand the state’s existing AV pilot program, effectively legalizing the limited deployment of commercial, for-hire autonomous passenger vehicles across New York, with the notable exception of New York City. This strategic exclusion of the densely populated, complex urban environment of Manhattan is typical of state-level AV regulatory frameworks, prioritizing simpler operational design domains (ODDs) first. This move places New York on a path to join other states that have opened their roads to commercial robotaxi operations.

Further regulatory scrutiny arrived from the Federal Trade Commission (FTC), which finalized an order banning General Motors and its OnStar telematics service from sharing certain consumer data with consumer reporting agencies. This order sends a powerful message across the connected vehicle industry: the vast streams of telematics data generated by modern vehicles are under intense regulatory surveillance, and misuse or unauthorized sharing will incur penalties. This focus on data privacy adds another layer of complexity for OEMs attempting to monetize connected services.

Finally, consumer access models are evolving. Tesla announced a pivotal shift for its Full Self-Driving (Supervised) software, moving away from a one-time purchase option and adopting an exclusive monthly subscription model. This strategic change aligns Tesla more closely with a recurring software-as-a-service (SaaS) revenue structure, maximizing long-term cash flow and mirroring the subscription economy trend prevalent across the tech industry. Meanwhile, the logistics sector continues to scale proven technology: Wing, the on-demand drone delivery service, announced a massive expansion of its partnership with Walmart, bringing drone delivery capabilities to another 150 retail locations, confirming the increasing viability and scalability of aerial last-mile logistics in suburban and rural environments.